Future-Proof Your Business

Leveraging the Solar ITC & IRA for 2025 Tax Relief

As we look toward 2025, savvy business owners are eyeing opportunities to maximize savings through the Solar Investment Tax Credit (ITC) – The Inflation Reduction Act (IRA) has expanded the benefits available to commercial solar adopters, and with growing concerns over rising electricity rates in California, now is the perfect time to invest in a sustainable future for your business.

The ITC remains a powerful tool for tax relief even with the shifting political landscape. Contact our expert team to learn how your business can take action today to secure significant tax savings.

The Future of the Solar ITC: Political Concerns and Realities

With the 2024 election cycle raising questions about the future of renewable energy incentives, many business owners may be wondering: Is the Solar ITC at risk under a Trump presidency in 2025?

While a Republican administration could potentially change the direction of US energy policy, it is important to understand that the IRA’s key provisions, including the ITC, are likely to remain intact for the foreseeable future.

According to Wood Mackenzie’s recent analysis, there are significant legislative and political roadblocks that make a full repeal of the IRA highly unlikely.

Even with potential shifts in policy priorities, the existing bipartisan support for renewable energy – driven by job creation and energy security – suggests that key tax incentives like the ITC are here to stay. This should offer reassurance to business owners considering solar: there is still time to lock in these valuable benefits, regardless of the political landscape.

The Benefits of Acting Now: Safe Harboring Your ITC Savings

While the future of energy policy may hold some uncertainties, one thing is clear – businesses that act now can safeguard their access to the ITC under the current framework. The concept of “safe harbor” allows companies to lock in their tax credit rates by starting the procurement process before potential changes take effect in 2025.

This means that even if there are modifications to the ITC, businesses that initiate their solar and energy storage projects today can benefit from the full value of the current credit.

The ITC offers a significant reduction in tax liability for companies investing in solar, covering up to 30% of the system cost. Additionally, the IRA introduced a series of adders, or bonuses, that can further increase the ITC.

Rising Electricity Rates: A Compelling Reason to Invest in Solar Now

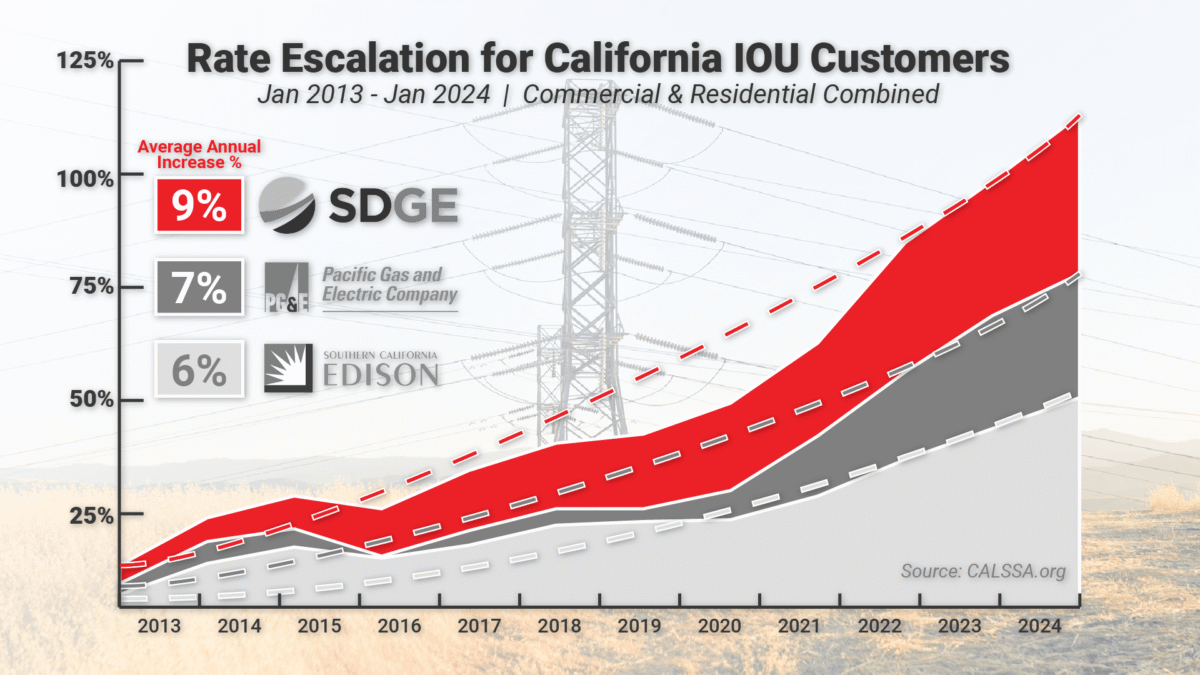

California businesses are facing a steady rise in electricity rates, a trend that shows no signs of slowing down. Electricity rates in California have risen faster than expected inflation over the past decade, putting a growing financial strain on commercial operations. By investing in solar, businesses can take control of their energy costs, reduce reliance on the grid, and protect themselves against future rate hikes.

The financial impact of rising electricity costs cannot be overstated—businesses that continue to rely solely on utility power are likely to see significant increases in their operating expenses. By choosing to install a commercial solar system, companies can reduce their energy bills, stabilize long-term energy expenses, and improve their bottom line.

Leveraging ITC Adders for Maximum Savings

The IRA has introduced several enhancements to the traditional ITC, providing additional incentives for businesses that meet specific criteria through 2025. Projects that use domestically produced solar panels and equipment can qualify for a domestic content adder, which boosts the ITC by 10%.

Another valuable adder is available for projects located in low-income or energy transition communities. These bonuses are designed to encourage solar development in areas that can benefit the most from clean energy access, while also providing substantial tax relief for companies making these investments. By taking advantage of these adders, businesses can significantly enhance the financial return on their solar projects.

Considerations for Non-Profit Partnerships

It’s also worth noting that while most of the IRA’s benefits apply broadly, there could be changes to specific provisions, such as the transferability of the ITC for non-profits.

Businesses partnering with non-profit organizations may want to take advantage of the current structure, which allows for flexible monetization of tax credits to benefit all parties involved. For example, non-profits that install solar can transfer their ITC benefits to a financing partner, making solar more accessible even without a direct tax liability.

Secure Your Businesses' Energy Future Today

With the evolving political landscape in 2025, it’s natural to have concerns about the future of renewable energy incentives like the IRA & the Solar ITC. However, the current outlook for the Solar ITC remains positive, and there are clear steps that businesses can take today to secure their savings.

By investing in solar now, companies can take advantage of the ITC, avoid the impact of rising electricity rates, and leverage valuable adders for maximum financial benefit. The window of opportunity is open, but it won’t last forever. Acting now allows you to safe harbor your solar and energy storage project, ensuring that your business can benefit from the current incentives, regardless of what happens in 2025.

Future-proof your business by taking control of your energy strategy today – embrace solar, reduce costs, and secure long-term sustainability.

Ready to explore how solar can help your business thrive?

Reach out to our team at Revel Energy. We’re here to help you navigate the incentives, design & build the perfect system for your needs and ensure that your company is positioned for a sustainable, cost-effective future.

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

As the popularity of electric vehicles increase, so does the demand for on-site charging. This sustainable amenity has become a parking lot fixture for competitive employers.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.