How Non-Profit Organizations Can Benefit from Commercial Solar Solutions

The demand for sustainable energy solutions is surging, driven by escalating electricity rates and a global push towards environmental responsibility. While for-profit businesses have long reaped the rewards of solar energy, recent changes to the Solar Investment Tax Credit (ITC) have opened new doors for non-profit organizations. As a leading renewable energy EPC,

Revel Energy has extensive experience in providing solar and energy storage solutions to California businesses, including non-profits like Big Brothers Big Sisters of Orange County.

The Rising Appeal of Solar Energy in California

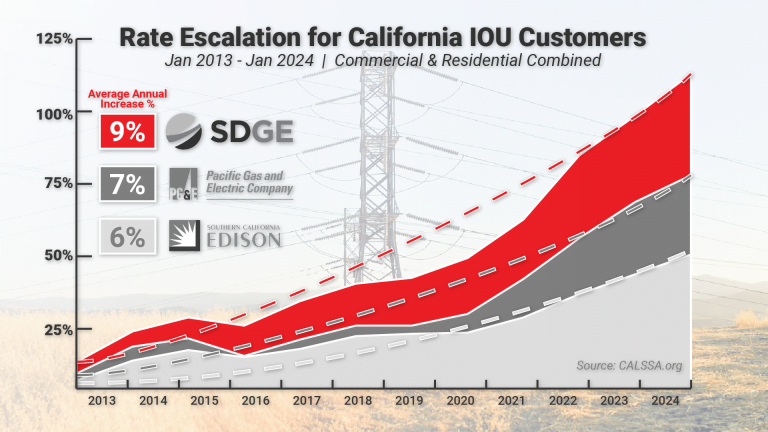

California businesses, both for-profit and non-profit, are increasingly seeking sustainable solutions to combat ever-increasing electricity rates. With utility costs consistently on the rise, commercial solar presents a proven investment to drastically reduce current and future electricity bills. This economic incentive, coupled with environmental benefits, makes solar energy an attractive proposition.

How The Solar Investment Tax Credit is Claimed by Non-Profits

Traditionally, non-profit organizations could not directly benefit from the Solar ITC due to their tax-exempt status. However, recent changes have revolutionized the landscape. Non-profits can now leverage the ITC through a “direct pay” provision, allowing them to receive a refund from the IRS equivalent to the tax credit value for solar projects placed in service after 2022.

This change is monumental for non-profits, enabling them to significantly lower the upfront costs of solar installations. To take advantage of this benefit, non-profits must pre-register with the IRS. The refund is calculated based on the project cost minus any tax-exempt funds received specifically for the project.

Additionally, non-profits have the option to transfer their tax credits to unrelated eligible taxpayers. This flexibility in financing opens new avenues for funding solar projects, making it easier for non-profits to go green and save on energy costs.

Case Study: Big Brothers Big Sisters of Orange County

A prime example of a non-profit harnessing the benefits of commercial solar is Big Brothers Big Sisters of Orange County. Partnering with Revel Energy, they successfully implemented a solar energy solution tailored to their needs. The project not only reduced their rising electricity bills but also underscored their commitment to sustainability.

Why Commercial Solar Makes Sense for Non-Profits

Cost Savings: Solar energy can drastically cut down electricity expenses, freeing up funds for core non-profit activities and programs.

Sustainability: Embracing solar energy aligns with the global push towards environmental sustainability, enhancing the organization’s reputation and appeal to eco-conscious donors and stakeholders.

Financial Incentives: The updated ITC provisions and potential for energy savings make solar a financially sound investment for non-profits.

Energy Independence: Solar energy systems can provide a level of energy independence, protecting non-profits from future utility rate hikes.

The Future is Bright for Non-Profits and Solar Energy

With the barriers to solar investment significantly reduced, non-profit organizations are well-positioned to take advantage of the myriad benefits offered by commercial solar solutions. At Revel Energy, we are committed to helping non-profits navigate this new landscape, providing expert guidance and tailored solar and energy storage solutions that maximize both financial and environmental benefits.

Getting Started with Solar for Your Non-Profit

For non-profit organizations looking to explore solar energy solutions, the journey begins with a thorough assessment of energy needs and financial goals. Partnering with an experienced EPC like Revel Energy ensures a seamless transition to solar, from initial consultation and design to installation and maintenance.

Our team understands the unique challenges and opportunities non-profits face. We are dedicated to providing customized solar solutions that not only meet energy needs but also align with organizational values and missions.

Learn If Your Non-Profit Organization Can Benefit From Solar & Energy Storage

The recent changes to the Solar ITC have leveled the playing field, allowing non-profit organizations to enjoy the same financial and environmental benefits that have driven the adoption of commercial solar among for-profit businesses. As electricity rates continue to climb, the case for solar and energy storage become ever more compelling.

Non-profits can now embrace solar energy with confidence, knowing that it is a wise investment that will yield long-term savings and sustainability. By partnering with Revel Energy, non-profits can embark on this transformative journey, securing a brighter, greener future.

For more information on how your non-profit can benefit from commercial solar solutions, contact us today. Let’s work together to power your mission with clean, sustainable energy.

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

As the popularity of electric vehicles increase, so does the demand for on-site charging. This sustainable amenity has become a parking lot fixture for competitive employers.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.