How to Calculate A Commercial Solar Investment

Evaluating Payback, ROI, NPV, IRR, ITC & LCOE

Many California agricultural, commercial & industrial businesses have reaped the financial benefit of installing commercial solar panels (solar panel systems, solar energy systems) – Revel Energy helps clients determine how to calculate the value of their investment potential by evaluating return on investment (ROI), payback period (often referred to as the solar payback period), internal rate of return (IRR), net present value (NPV), Investment Tax Credit value (ITC) – including the federal tax credit, investment tax credit, and tax credits – and levelized cost of energy (LCOE).

Along with the proven financial benefits of solar power and clean energy, there are growing intangible benefits that bolster project economics, such as employee recruiting and retention, customer satisfaction, company image and reputation in their community along with other factors that help businesses stand above their competitors, including a reduced carbon footprint and notable environmental benefits.

For many businesses in 2025, reducing rising monthly energy costs and electricity bills alone is enough to make commercial solar a valuable investment. By offsetting utility bills with free electricity generated on-site from the sun, businesses can protect themselves from constantly-increasing utility rates (including surges in electricity rates and cost of electricity). This allows them to be more competitive and increase cash flow through reduced operating costs (and operational costs), with the added benefit of increased property value as a result of adding solar to their building (commercial property).

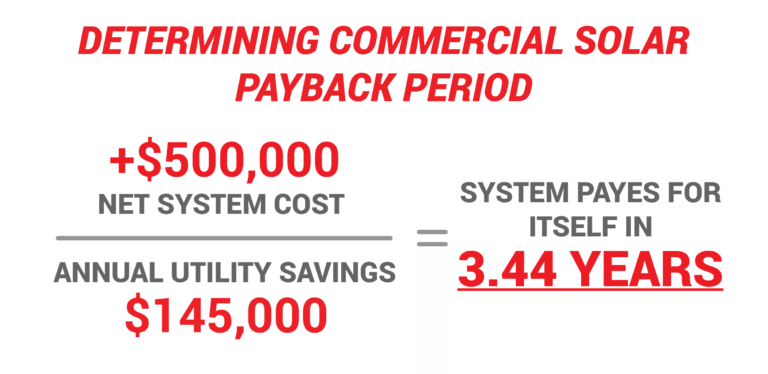

Commercial Solar Investment Financing - Payback Period

There are many ways California businesses can finance a commercial solar investment (including various financing options). An outright cash purchase allows businesses to take advantage of all available incentives and typically has a short payback period (or solar payback period) between 3 and 7 years – benefiting from programs like the solar investment tax credit.

The largest percentage of the eligible tax incentives (tax benefits) are recovered in the 1st year the system is operational, allowing system owners to have an accelerated payback period (a form of accelerated depreciation).

Commercial solar panel installations quickly pay for themselves by generating electricity for the facility through offsetting their electricity demands from the utility with solar energy—an attractive alternative to traditional energy sources—resulting in significantly reduced electricity bills (and utility bills, offering potential excess electricity). As energy costs have continued to rise faster than expected, Revel has observed an equally unprecedented increase in solar savings year over year. With many of Revel’s solar customers who had looked into solar in past years reaching out to re-explore the option, they are now finding solar ROI even shorter and missing out on years of substantial savings. This is a major benefit for many businesses.

An important factor, but calculating commercial solar investment feasibility is more than a payback period, as it doesn’t account for inflation, maintenance costs, depreciation, project lifetime, and other variables like rate of return. (It requires Careful consideration of all related project costs.)

Solar Return on Investment (ROI) for Businesses

Return on investment (solar ROI) provides businesses with an overview of a commercial solar project’s economics over its lifetime. These solar energy systems are designed to last over 25 years, with solar panels maintaining approximately 85% of their original energy output at 25 years, ensuring peak efficiency and long-term financial return.

Revel Energy calculates agricultural, commercial and industrial solar installation ROIs through conducting a detailed analysis and considering many site-specific variables; these include:

- Current utility kilowatt-hour (kWh) electricity rates and demand charges (reflecting energy consumption and annual consumption).

- Current annual electricity bill (and energy bills).

- Projected annual increase of electricity costs over the system’s life.

- System installation costs (based on the prices from installers and the average cost for the upfront cost), inverter replacement, operations, routine maintenance, and maintenance costs.

- Calculated lifetime value of all incentives and programs like ITC and NEM (performance-based incentives, solar tax credits).

- Additional costs like permitting, utility infrastructure upgrades, connection fees, taxes, interest or loan costs (project costs).

At Revel Energy, we strive to design sustainable systems with lifetime benefits like positive cash flow from lower and predictable energy costs. These financial benefits provide consistent return on investment, and beyond this there are other intangible benefits. These benefits include reducing vulnerability to utility price increases, reducing reliance on fossil fuels, promoting renewable energy and environmental sustainability, and being a sustainable business and good steward to the community. There are some factors ROI does not represent, like the value of the money being invested when factoring in inflation, risk, or other lost opportunity costs—all of which contribute to a clear financial advantage and improved operational efficiency.

Solar Investment Net Present Value (NPV)

Net present value (NPV) considers the overall time value of money involved with an investment. For example, in a commercial solar investment, we calculate NPV to show the 30-year project lifetime cash flow compared to the current value. Importantly for this calculation, we look forward and account for inflation, risk, and other lost opportunity costs like potential alternative investments—ensuring informed decisions regarding your initial investment and understanding the cost over time as with any renewable energy project.

Present value compared against future value is an important consideration for any commercial solar investment. To project a future value, we include all upfront costs of installation (including installation costs), plus the projected electricity bill savings (or annual energy savings), divided by a discount rate. After significant project experience, Revel has proudly proposed many projects to customers with accurate and positive NPV estimations.

Internal Rate of Return (IRR) of a Solar Investment

While NPV can show the value of an investment over time, internal rate of return (IRR) reveals the rate of return from NPV cash flows that agricultural, commercial, and industrial solar investments generate. This metric is particularly valuable when identifying a solar project’s value compared to other projects during the capital budgeting process.

Determined by many variable factors, similar to NPV and ROI, our proposals target an IRR between 10% and 15% which is higher than the minimum acceptable rate of return for many companies, demonstrating a strong financial return.

Solar Investment Tax Credit (ITC)

The Federal Investment Tax Credit (ITC) offers a substantial 30% tax credit for businesses investing in solar energy, energy storage (including solar battery options), and EV charging stations, significantly reducing the initial cost of these sustainable technologies. Newly introduced features of the ITC now include the option for a direct payment to tax-exempt entities, such as non-profit organizations, enabling them to benefit from these financial incentives without tax liability—providing a clear direct benefit. This federal incentive offers the advantage of tax credits and broadens the accessibility of clean energy investments, promoting wider adoption across diverse sectors (including options for solar without rooftop panels, backup batteries, and heat pumps).

Evaluating Different Solutions Through Levelized Cost of Energy (LCOE)

Some investment decisions benefit from evaluating the value of energy production divided by the lifetime costs associated with the system; this long-term evaluation is the levelized cost of energy (LCOE). This metric considers capital costs, operations and maintenance (O&M), performance, fuel costs of renewable energy technologies and is particularly helpful when comparing different alternative solar solutions to solar like wind or natural gas.

LCOE presents a unique method of showing the present value of the total cost of building and operating an energy solution over its assumed lifetime. By comparing this against the current cost of electricity and energy costs, renewable solutions often prove to be significantly positive investments over long periods of time. The National Renewable Energy Laboratory (NREL) has a terrific resource to help calculate LCOE here.

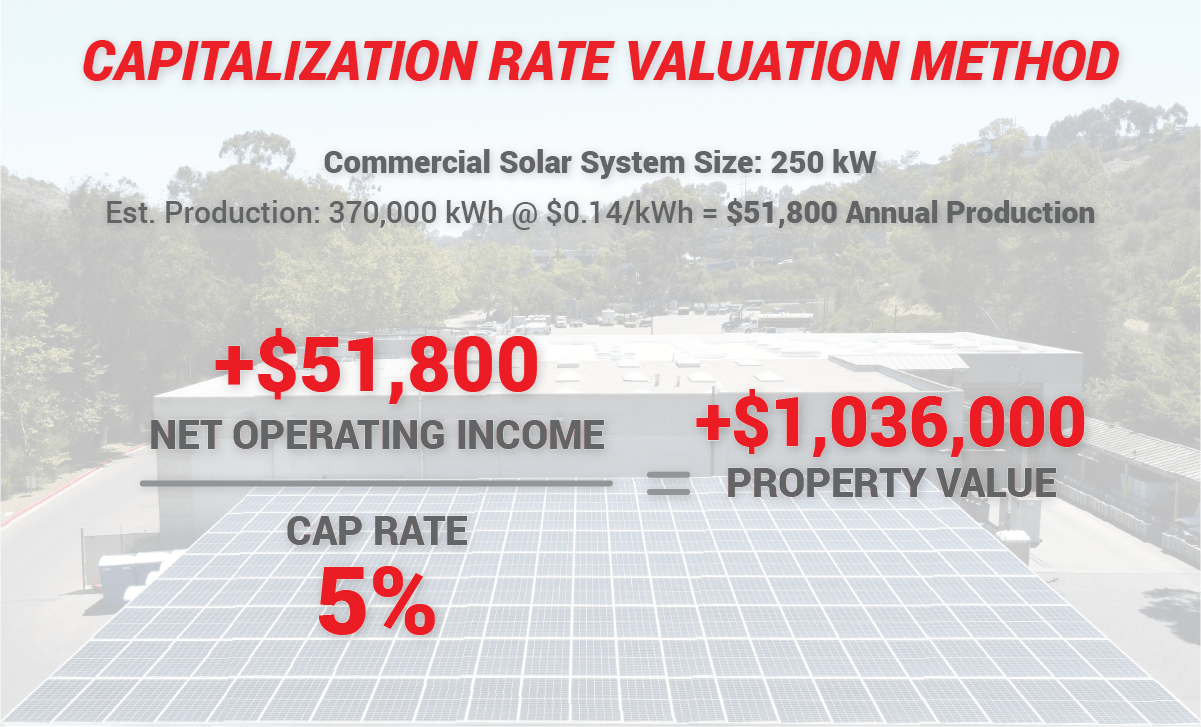

Calculate Added Property Value with a Commercial Solar Investment

As more and more California businesses realize the potential of commercial solar investments, they add significant value to their commercial property. Adding new sustainable technology increases a building’s value in several ways, most tangibly by increasing annual income by lowering operating expenses (and operating costs), which is then divided by the cap rate, thus growing property value and achieving an increase in property value.

Sustainable buildings are more attractive to prospective tenants; this gives green building owners an advantage over competitors. For existing tenants (i.e. a tenant 4 years into a 10-year lease), solar provides an opportunity to extend and/or renegotiate leases, thus increasing the Net Present Value (NPV) and supporting a sustainable future.

2025 Energy Costs in California: Why Now Is the Time to Go Solar

California businesses are bracing for a dramatic rise in energy costs as the state’s electricity usage and demands continue to surge. While powering energy-intensive artificial intelligence (AI) technologies and supporting the clean energy transition are key factors, the primary driver behind rising energy prices is unchecked utility spending in an unpredictable electricity market.

Investor-owned utility companies have increased their transmission and distribution (T&D) spending by 300% since 2005, passing these costs onto ratepayers. For businesses, this escalating trend makes 2025 a pivotal year to consider adopting commercial solar and energy storage solutions to hedge against these financial pressures and the rising cost of power.

The Power of Power Purchase Agreements (PPA) for California Businesses

An increasing number of businesses are turning to power purchase agreements (PPA) as a cost-effective way to install commercial solar (solar installations, solar projects). PPAs offer a way to utilize existing budgeted operating expenses to gradually finance a more sustainable electricity source.

By entering into a PPA, businesses can secure solar energy at a fixed, predictable rate, often lower than the utility’s rate. This approach mitigates the impact of rising electricity rates and also aligns with the growing prevalence of environmental sustainability and sustainable business practices.

A solar power PPA protects businesses from a future of rising electricity costs by locking in a predetermined escalation rate, using solar generation to offset electricity bills and provide financial and operational flexibility, leading to savings on energy bills.

Contact our expert team to learn if your business can benefit from commercial solar through a Power Purchase Agreement (PPA).

Calculating Agricultural, Commercial & Industrial Solar Investment Feasibility

Commercial solar investment is a complex and calculated financial decision and often businesses can be reluctant to invest capital that they could put into other areas of their business. Revel can help businesses evaluate this decision and offer options that won’t require a large up-front initial cost. Property owners and commercial developers holding buildings and facilities with high energy demand—including options for Larger systems—could benefit from commercial solar investments almost instantly with short payback periods, overwhelmingly positive ROI, NPV and IRR.

Californians pay some of the highest electricity rates in the country, and investor-owned utilities are consistently granted rate increases to pay for both new and aging infrastructure. Solar investments provide many benefits to landlords and tenants alike, first and foremost reducing electricity costs and, just as importantly, this sustainable technology adds long-term value to a property, contributing to an increase in property value.

Revel Energy has helped many business owners, landlords, and commercial property owners generate positive cash flow while investing in the future. Contact us today to claim energy independence through installing commercial solar installations, reducing your electricity bills, allowing you to put more money into your business—whether you’re an average mid-sized or small business or a large corporation—creating a positive impact on your bottom line, securing a robust corporate future, and experiencing the benefits of solar. Our solutions feature a panel system simple design for ease of maintenance, empowering business leaders to make informed decisions and ensuring a strategic investment for years to come.

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

As the popularity of electric vehicles increase, so does the demand for on-site charging. This sustainable amenity has become a parking lot fixture for competitive employers.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1106092

See how these businesses saved on electricity, gained valuable tax credits and rebates with commercial solar and energy storage.

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.