The Solar ITC Explained

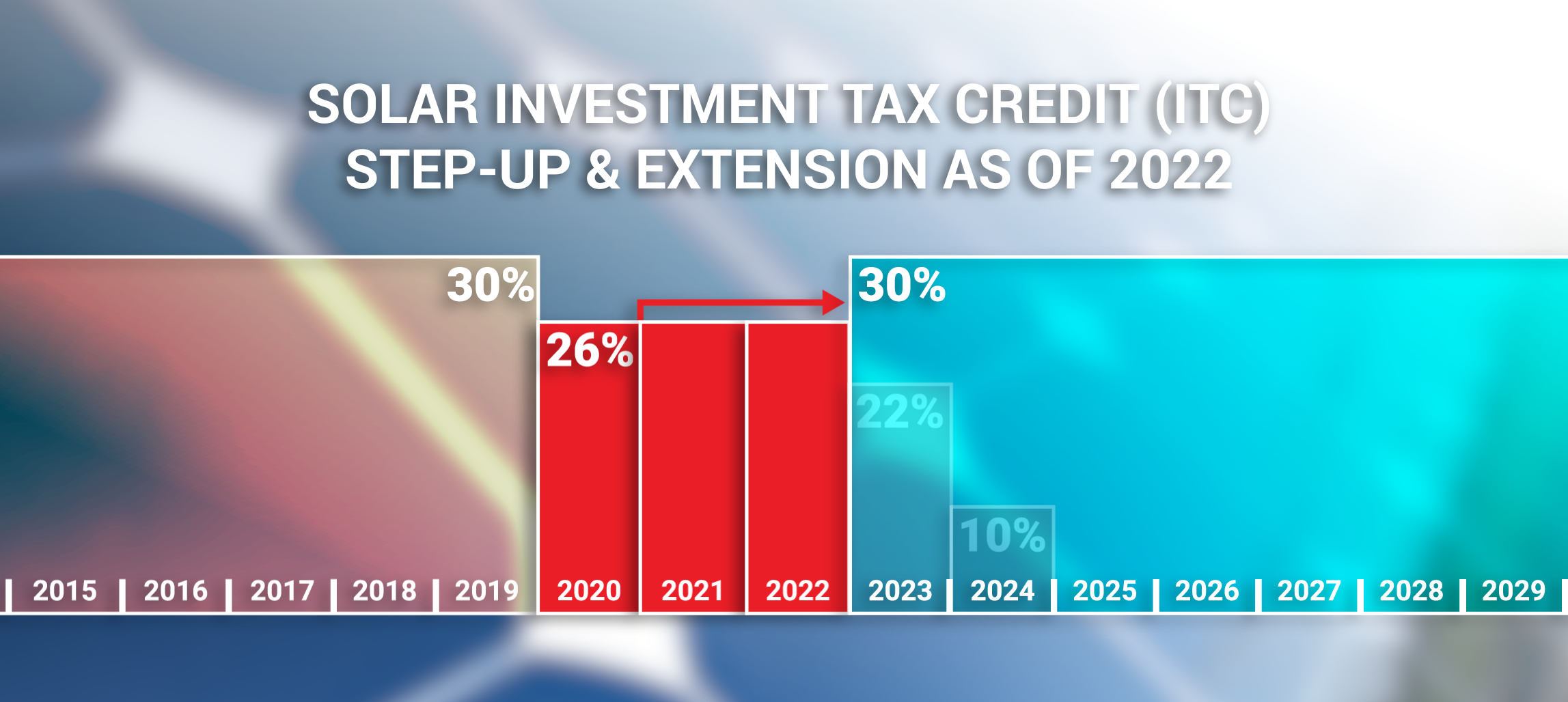

Solar Investment Tax Credit (ITC) Highlights:

- 2022 ITC rate is now 30%, up from 26%

- 2023 was scheduled to step down to 22%

- 30% ITC lasts through 2032

Previously scheduled to step-down in 2021, the Solar ITC (Investment Tax Credit) was extended as part of the COVID-19 relief spending. The ITC was extended again in August 2022 and increased to its original value by the Inflation Reduction Act.

This translates into an additional 4% discount and shorter payback period for businesses still looking for agricultural, industrial or commercial solar solutions.

Businesses with high electricity costs investing in solar take advantage of the dollar-for-dollar tax credit, all while reducing electricity bills and reliance on aging infrastructure.

Thanks in part to the Solar ITC, typical electricity bill savings for Revel Energy customers is between 50 to 80%. The first step-down phase in 2020 dropped the Solar ITC from 30 to 26%, and instead of another 4% dip after 2022, the credit value was extended and increased to 30% until 2032.

How Is The ITC Credit Value Calculated?

For a business considering commercial solar investment at a gross cost of $500,000, the tax credit would be worth $150,000. Here’s an example case study of a business taking advantage of the Solar ITC back when it was at 26% value to help pay for their commercial solar system.

That means their tax bill for that year is $130,000 less than they had planned, keeping much needed cash in the company. Going forward in 2022, this value would now be $150,000 until 2032 thanks to provisions within the Inflation Reduction Act.

Businesses that don’t need to use the whole credit in one year can spread it out over time potentially eliminating any tax liability for several years. Along with acquiring the 30% tax credit, the business also acquires depreciable assets. In this case, after Federal bonus and State depreciation, the net cost comes out to around $210,000.

Similar systems have saved businesses an estimated $100,000 annually by generating free electricity, offsetting demand from their utility. That is more money they used for hiring much needed talent, upgrading machinery, or any other cash needs the company may have. Creative financing options like the Commercial Property Assessed Clean Energy, or C-PACE, help make commercial affordable for more businesses.

Contact us today to learn how much your business could save on its annual electricity bills with commercial solar.

About Revel Energy

Revel is on a mission. Dedicated to renewable energy solutions since 2009, Revel Energy was formed to provide Commercial, Industrial and Agricultural businesses with alternative energy beyond solar. Revel stands out from the competition by paying attention to what makes good business sense to each individual client, implementing a wider range of technologies to free up capital and make businesses sustainable and more profitable.

ROOFTOP SOLAR

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

ENERGY STORAGE

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak hour charges

LED LIGHTING RETROFIT

Generating independent solar power is one piece of the puzzle. Energy saving equipment like highly efficient LED Lighting completes the system. Significantly reduce energy usage.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.