Rising Electricity Costs for California Businesses in 2023

In 2023, the cost of electricity in California for businesses is rapidly increasing; however, commercial, agricultural, and industrial properties can fight these rising costs sustainably with commercial solar, energy storage and other facility-specific solutions. Our team conducted an in-depth study on various businesses across California to track how much their electricity rates had risen over the last few years.

California Investor-Owned Utility Electricity Rate Case Study (SCE, SDGE, PGE)

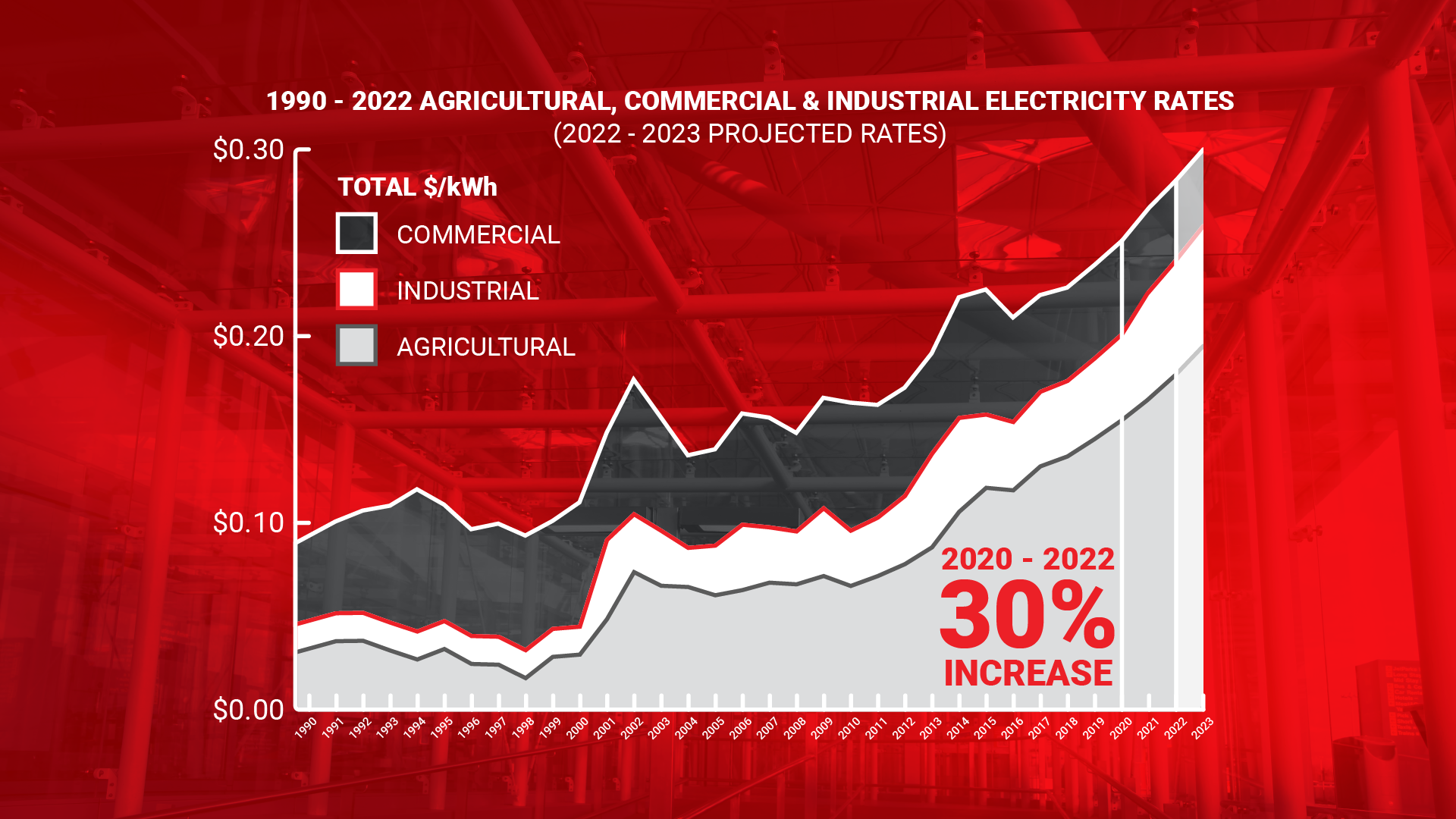

How Much Have California’s Electricity Rates Increased for Businesses?

For a majority of utility customers in California, businesses included, the average commercial retail price of electricity has increased on average by about 3.5% per year from 2001 to 2020. However, after global events in 2020 such as the coronavirus pandemic, rates through 2023 have risen much higher than previous averages. Some customers are paying annual increases as high as 23%, these are unexpected costs that are obviously required to keep the business running.

For agricultural customers, the cost of electricity can vary depending on the type of farming operation. For example, irrigation pumps and other equipment used in large-scale irrigation systems can be significant energy users, which can increase the cost of electricity for farmers.

For industrial customers, the cost of electricity can also vary depending on the type of industry and the specific processes used. For example, industries that use large amounts of energy, such as steel and aluminum production, can see higher electricity costs than other industries. Additionally, the cost of electricity for industrial customers can be influenced by factors such as commodity prices, production levels, and environmental regulations.

Our team gathered data from our customers within California’s IOU service areas to learn how much electricity rates are increasing for these types of businesses. These are general averages, the cost of electricity can vary widely depending on the location, type of industry and specific business operations.

Drastic results were found in a study from EnergyToolbase aimed at understanding electricity cost inflation over a ten-year period from 2014 through 2023 for both residential and commercial customers. Read more in our blog post, or read ETB’s excellent study here.

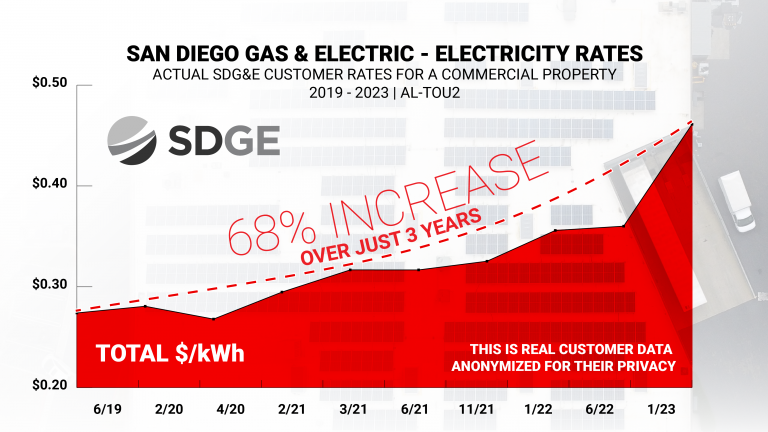

San Diego Gas & Electric (SDGE) Commercial Business Electricity Rate Study

As we found in our electricity costs case study last year, San Diego Gas and Electric (SDGE) rates for commercial, industrial and agricultural customers are climbing the quickest out of California’s investor-owned utilities. Providing electricity and gas services to more than 3 million consumers, SDGE is a regulated public utility owned by Sempra, a Fortune 500 energy services holding company.

This graph represents SDGE’s electricity rate data for plan AL-TOU2 from June 2019 through January 2023, collected from one of our customers. Averaging almost 23% annual increases over that short period of time, this business saw their overall electricity rate had jumped by 68%.

Looking to mitigate these consistently rising costs, this business was highly motivated to seek out alternative solutions like solar and energy storage to eliminate the cost uncertainty that cast a shadow over their bottom line. This business quickly contacted Revel Energy for a free obligation-free quote from our expert team.

This commercial property was prompted by their fast-rising bills, but a competitor in the area proactively installed solar to mitigate these significant cost increases.

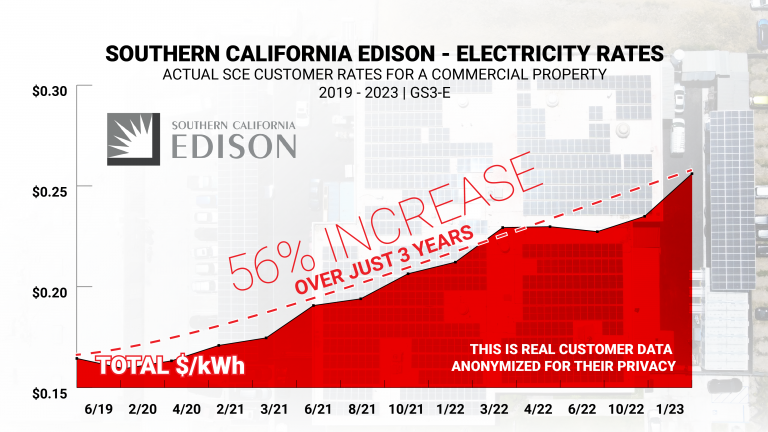

Southern California Edison (SCE) Commercial Manufacturing Facility Electricity Rate Study

California’s second-largest investor-owned utility, Southern California Edison (SCE) is also on a high rate trajectory as we found in this and our last electricity cost case study on a similar rate plan for a commercial manufacturer. SCE serves almost 5 million customers as the largest subsidiary of Edison International.

This graph shows how much SCE’s electricity rate had increased for a commercial manufacturer under plan GS3-E from June 2019 through January 2023. Over just three years, this manufacturing facility would have been seeing 56% higher electricity bills. An annual average rate increase of almost 19% was drastically mitigated by a rooftop solar system, supported by energy storage, that started producing electricity at the beginning of 2019.

Covering a majority of southern California, SCE and all utility providers are under serious pressure as they continue to increase rates for consumers. These high prices could slow down California’s plans to bring more electric vehicles and the infrastructure to support them. As the state aims for 100% of new passenger vehicle sales to be zero-emission by 2035, many question how utility providers aim to achieve the state’s goals for electrification through drastic rate increases.

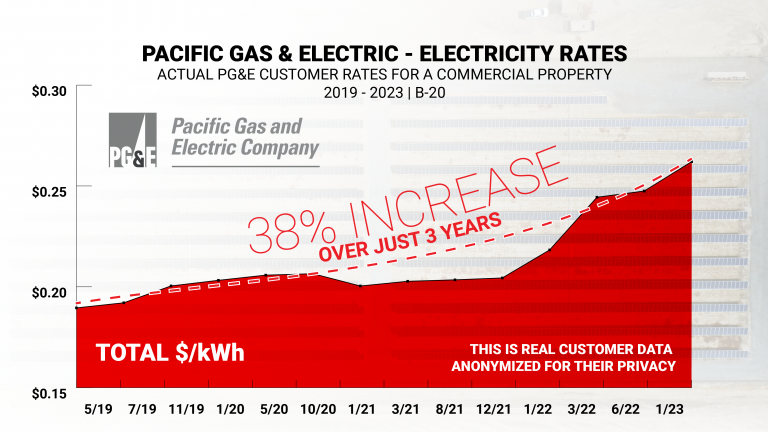

Pacific Gas & Electric (PGE) Commercial Agricultural Facility Electricity Rate Study

The largest utility in the nation, Pacific Gas and Electric (PGE) also shares a history of increasing rates even before lawsuits found PGE’s aging infrastructure to blame for multiple fatal wildfires, which eventually led them to file for bankruptcy in 2019. PGE has the largest service area in California, from as far south as Santa Barbara up north to Humboldt, PGE provides electricity to more than 5 million agricultural, residential, commercial and industrial customers throughout central and northern California.

Here is a graph that shows PGE’s electricity rate increases for a commercial agricultural facility under plan B-20 from May 2019 through January 2023. Annually increasing by an average of almost 13%, in only three years the cost of electricity had jumped by 38%.

Like many other businesses, this commercial agricultural facility considered capital investment in solar for 2020, but had to delay considerations due to effects from global events like the COVID-19 pandemic.

However, through flexible financing options and timely incentives, this commercial agricultural facility was able to finance and install a bespoke solution, designed by Revel Energy to efficiently fill needs throughout the property.

As the IOU fights back from bankruptcy costs are passed onto the customer, even more so as PGE looks to invest and avoid future emergency costs through wildfire prevention measures.

Why Are California’s Electricity Costs Increasing in 2023?

One source of California’s rising electricity costs for businesses in 2023 is the state’s ambitious clean energy goals, which have led to the closure of several fossil fuel-powered power plants and an increased reliance on renewable energy sources such as solar, energy storage and wind. While these sustainability efforts are commendable from an environmental standpoint, they have also led to a tighter supply of electricity, which causes utilities to increase their rates. Natural gas is also facing serious price hikes as high as 300% in January 2023, prompting Governor Gavin Newsom to call for a federal investigation on the price spike. This unfortunately also pushes up electricity rates since gas provides more than 50% of the state’s electricity demand.

Another significant factor that contributes to the rising cost of electricity in California is the state’s transmission and distribution infrastructure. The state’s electrical grid is aging and in need of upgrades and expansion, which will be very costly. Revenue requirements for these investor-owned utilities have put pressure on rates and infrastructure costs, potentially slowing the overall effort to modernize the grid.

California’s big 3 investor-owned utilities, Southern California Edison, San Diego Gas & Electric and Pacific Gas & Electric recently won a battle against California’s solar industry where new projects after April 2023 receive significantly less value for excess solar energy exported to the grid. Utility providers across the globe are acting quickly to find ways to meet drastically increasing demand as more fossil fueled energy sources are electrified.

Electricity Bills Will Continue to Grow - Act Now Before Your Competition

California businesses can expect their electricity costs to continue to rise past 2023 and into the future, driven by many factors such as inflation, increased demand, increased supply costs, clean energy / sustainability goals, aging infrastructure and the need to upgrade and expand transmission and distribution systems.

Many commercial, agricultural and industrial businesses have adopted and are considering implementing sustainable solutions such as commercial solar, energy storage and other solutions to reduce their energy costs and become more energy independent. Those already equipped are at an advantage, actively generating their own electricity to curb the burden of rates repeatedly rising.

Don’t wait any longer to take control of your energy costs – contact our expert team today and learn how our commercial solar and energy storage solutions can help your business save money and become more sustainable.

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

As the popularity of electric vehicles increase, so does the demand for on-site charging. This sustainable amenity has become a parking lot fixture for competitive employers.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.