Inflation Reduction Act Energy Community Tax Credit 10% Bonus for ITC

Defined in the updated guidelines for the Inflation Reduction Act (IRA), there is a bonus 10% available to those who take the solar investment tax credit and are within certain areas outlined in new energy community tax bonus guidelines. These energy communities are identified to help support and revitalize the economies of coal and power plant communities.

The IRA increased the value of the ITC back up to 30%, businesses in these areas can now access this bonus for a valuable 40% (and potential 50%) tax credit on a proven property improvement like commercial solar.

How Does the IRA Define Energy Communities?

The areas that can receive increased credit amounts or rates if they satisfy certain energy community requirements such as being on a brownfield site, meeting certain unemployment thresholds, or around a census tract that includes a closed coal mine or retired coal-fired generator.

Here are the specific requirements for energy communities defined by the IRA;

- A brownfield site (as defined in certain subparagraphs of the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (CERCLA))

- A metropolitan statistical area (MSA) or non-metropolitan statistical area (NMSA) that has (or had at any time after 2009)

- 0.17% or greater direct employment or 25% or greater local tax revenues related to the extraction, processing, transport, or storage of coal, oil, or natural gas; and

- has an unemployment rate at or above the national average unemployment rate for the previous year

- A census tract (or directly adjoining census tract)

- in which a coal mine has closed after 1999; or

- in which a coal-fired electric generating unit has been retired after 2009

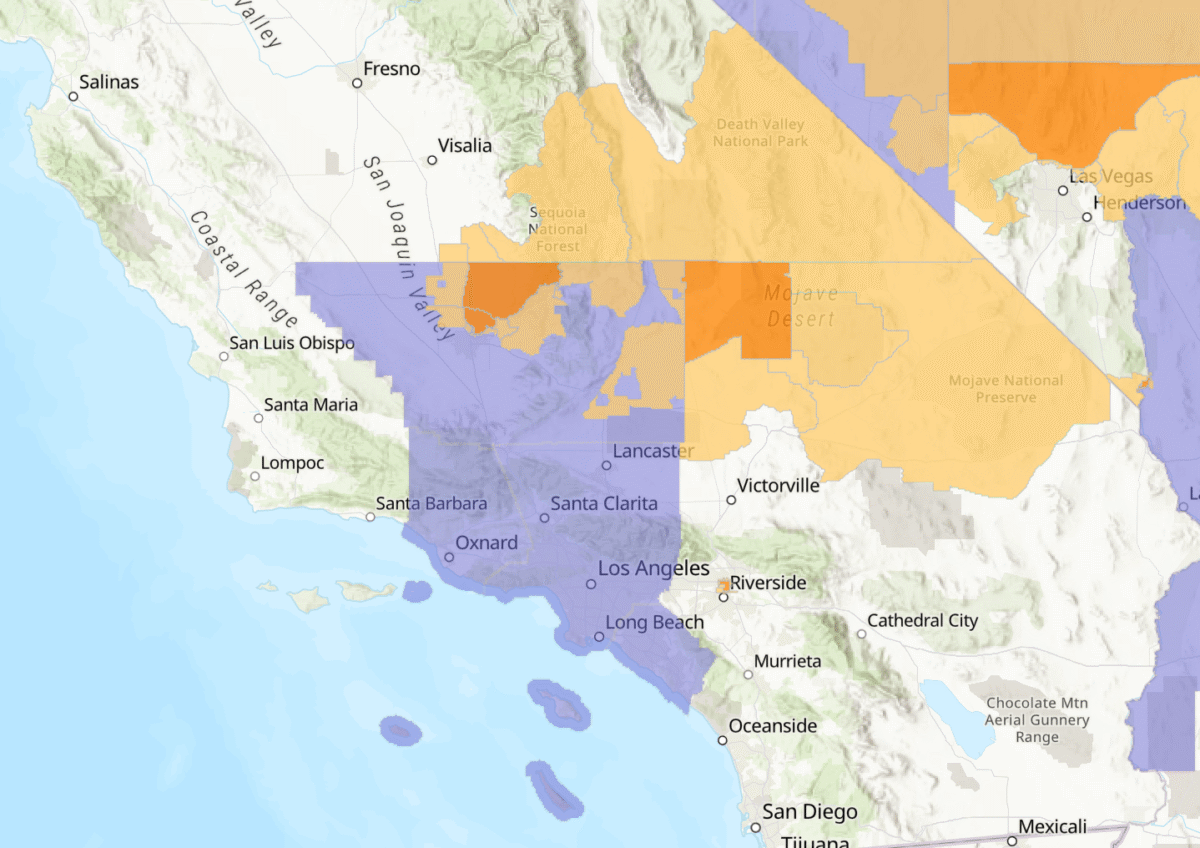

California Counties Included in the Energy Community Tax Credit Bonus

In California, Los Angeles, Kern, Ventura and Orange Counties are all listed as metropolitan statistical areas that meet both fossil fuel employment and unemployment requirements. Some sections within San Bernardino Riverside, Tulare and Inyo Counties can also access this bonus 10% as they may have or be near a coal-fired electric generator retirement.

Other regions that can access this bonus incentive can be identified through a helpful map provided by the U.S. Department of Energy, excluding brownfield sites. Additional information on energy communities, related tax credits, and contact information for addressing questions can be accessed on the Interagency Working Group on Coal & Power Plant Communities & Economic Revitalization Energy Communities website.

50% Solar ITC by Combining Energy Community and Domestic Content Bonuses

Also available for both ITC and PTC, there is an additional 10% available for using required amounts of domestic content like U.S.-produced steel, iron and manufactured products. As a result, businesses within an energy community increase base ITC of 30% to 40% and could further increase to 50% if they also follow through on these domestic content guidelines.

This will further increase the strained demand for domestic solar panels, racking and inverters, but will be helped as more manufactures continue to develop throughout the United States, this is by design as a goal within the IRA.

IRA Uses Solar Investment Tax Credit to Help Revitalize Communities

After the IRA increased the solar ITC back to 30%, the US solar industry was reported to have its best Q1 ever in 2023. That growth will continue as businesses notice their competitors are capturing serious savings while they’re spending more and more on rising electricity bills.

Contact our expert team today to learn if your business may be able to take advantage of the IRA Energy Community Tax Credit and access 40%, or even 50% on the solar ITC.

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

As the popularity of electric vehicles increase, so does the demand for on-site charging. This sustainable amenity has become a parking lot fixture for competitive employers.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.