How to Claim the Solar Investment Tax Credit (ITC) for Businesses

The Federal Investment Tax Credit (ITC) has been key to how businesses access sustainable property improvements like commercial solar and energy storage. In 2022, the Inflation Reduction Act added another 10 years of the 30% tax credit and more opportunities to increase the value and flexibility of the incentive such as additional 10% bonuses for energy communities and using domestic content.

Along with allowing non-profit organizations to access a direct payment through the program, the IRA also granted the ability to carry unused credits three years backward or forward by up to 22 years.

The solar ITC is a federal incentive that takes planning, documentation and consideration to access its benefits. Through our work installing these solutions for California businesses, our team is often asked; “How do I claim the solar ITC for my business?”

The following is intended to highlight some details of the process. Revel Energy is not a tax professional. We sourced official IRS documents to best explain the process in its high level simplest form. We always advise our clients to consult the tax professionals.

Follow these quick steps when claiming the credit for solar investment credit.

How Businesses Claim The Solar Investment Tax Credit (ITC)

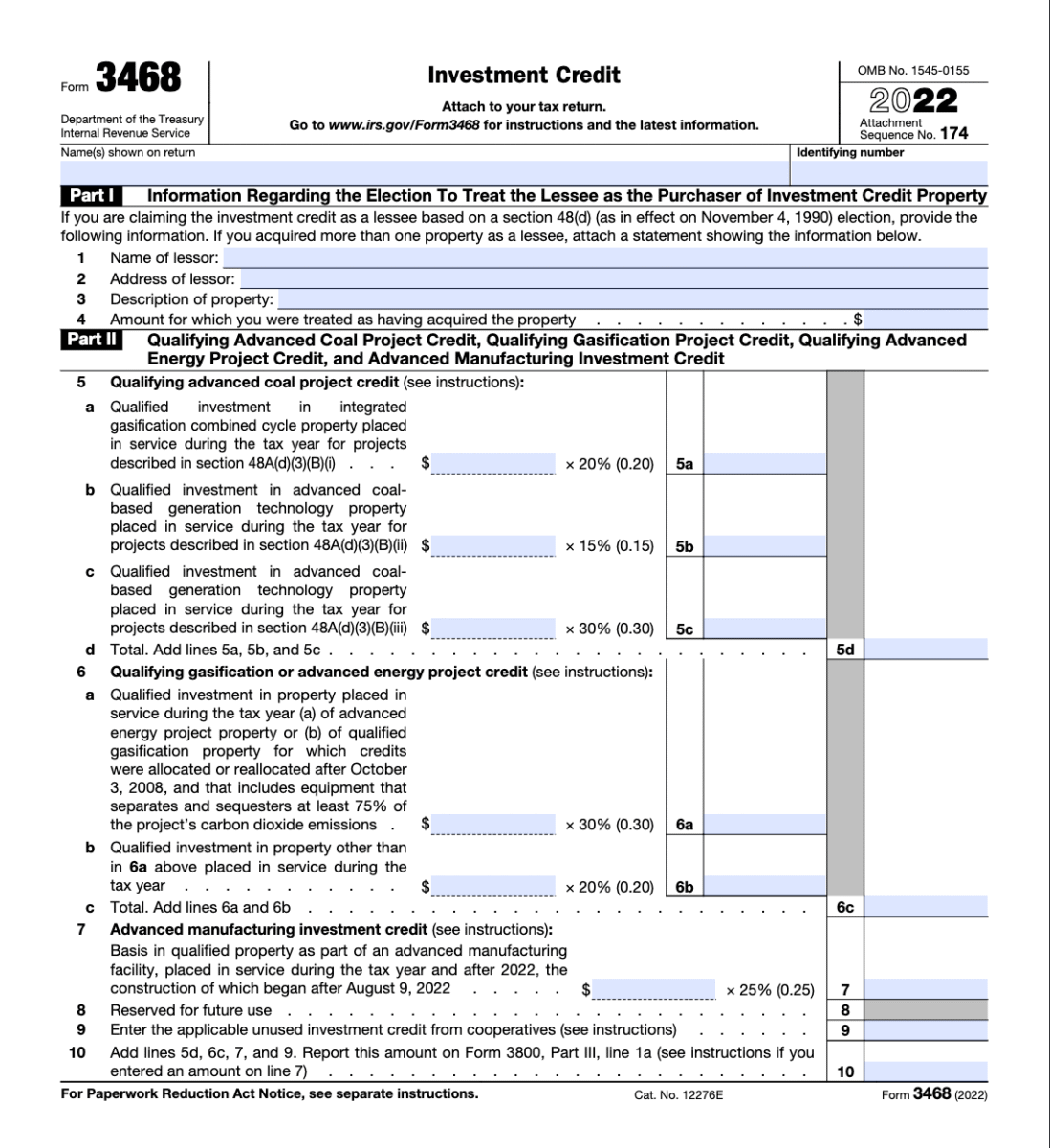

Businesses claim the solar ITC by submitting IRS Investment Credit form 3468 which calculates the value of the credit on the cost basis of the project. This is a general form that uses accounting principles outside of Revel Energy’s professional scope. Consult your tax professional to more thoroughly and accurately fill out the form.

Form 3468 requires important details, businesses can follow these quick steps when claiming the credit for a solar investment:

- Fill out part 1

- Line 3 – Describe the solar installation

- Line 4 – Cost basis of project

- Skip part 2, go to part 3, step 12

- Line 12c – Cost basis of project, then multiply by (0.3) as instructed.

- Line 12hh – In the case your business qualifies for additional credits, you must use the 3468 instruction form to calculate the extra value, like energy communities or domestic content adders.

- Combine and list result on line 14

- Attach to the tax return submitted in the year your business wants the credit.

What Projects are eligible for the ITC?

According to the Office of Energy Efficiency & Renewable Energy, for a business to claim the ITC or PTC, the solar modules, energy storage system, and/or EV charging stations must be:

- Located in the U.S. or U.S. territories.

- Use new and limited previously used equipment.

- Not leased to a tax-exempt entity – however, recent updates allow tax exempt entities to receive the ITC through direct payment.

Investment Tax Credit (ITC) versus Production Tax Credit (PTC)

The difference between the original investment tax credit and the production tax credit is that the ITC provides an upfront credit taken after the system is installed, while the PTC has the potential to earn more over time based on the lifetime production of a system.

Choosing between the two is dependent on many variables like project costs, tax appetite, sunlight availability, potential bonus credits, and more. In general, large-scale projects with more sun exposure would receive more value from the PTC. Alternatively, projects where a business might need the tax write off, is facing high installation costs, or possibly qualifies for bonus credits, the ITC would be more beneficial.

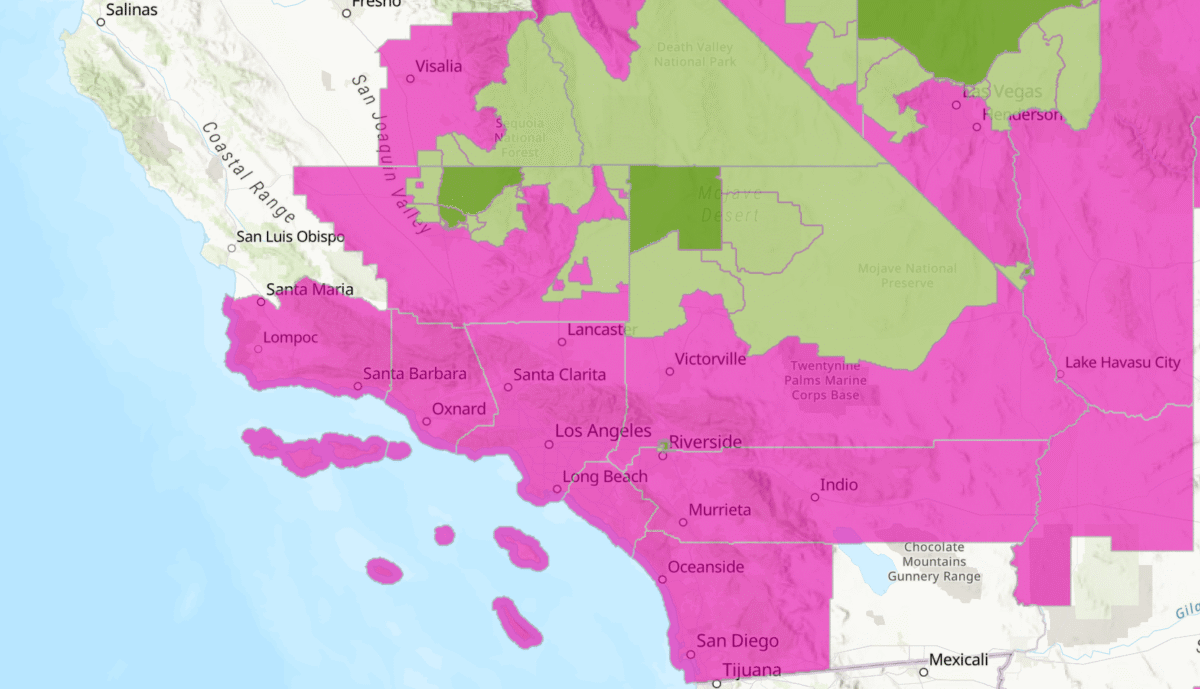

California Counties Included in the Energy Community Tax Credit Bonus

In California, Los Angeles, Kern, Ventura and Orange Counties are all listed as metropolitan statistical areas that meet both fossil fuel employment and unemployment requirements. Some sections within San Bernardino Riverside, Tulare and Inyo Counties can also access this bonus 10% ITC as they may have or be near a coal-fired electric generator retirement.

Other regions that can access this bonus incentive can be identified through a helpful map provided by the U.S. Department of Energy, excluding brownfield sites. Additional information on energy communities, related tax credits, and contact information for addressing questions can be accessed on the Interagency Working Group on Coal & Power Plant Communities & Economic Revitalization Energy Communities website.

Install Commercial Solar & Claim the Solar ITC for your Business

Revel Energy is committed to our customers, and our team ensures that customers receive their expected value from the ITC, providing the expected value of the project’s credit during the proposal process. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Our expert team is ready to help your business find the solution best fit for the needs of any facility, using renewable technologies like commercial solar and energy storage to significantly reduce electricity bills. Contact us today to learn how your building can create capital through sustainability.

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

As the popularity of electric vehicles increase, so does the demand for on-site charging. This sustainable amenity has become a parking lot fixture for competitive employers.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.