The so-called “Big Beautiful Bill”—officially the One Big Beautiful Bill Act (OBBBA)—is a sweeping U.S. federal reconciliation law enacted on July 4, 2025, that significantly overhauls clean energy tax incentives established under the Inflation Reduction Act (IRA).

For commercial and industrial property owners in California, where electricity costs remain among the highest in the nation, understanding these changes is critical. The bill affects everything from solar leases and Power Purchase Agreements (PPAs) to financing pathways and compliance with new domestic sourcing rules.

In this guide, we’ll outline how the Big Beautiful Bill impacts energy tax credits, which deadlines matter most, and why 2025 is the safest year to act before uncertainty ramps up.

The Legislative Foundation: From IRA to the Big Beautiful Bill

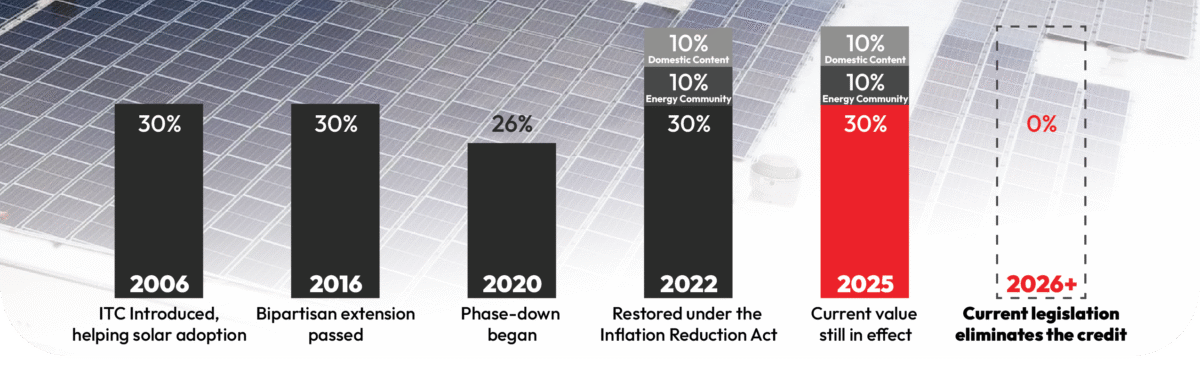

Let’s start by looking back at the Inflation Reduction Act (IRA), the single most significant piece of energy legislation in decades.

Inflation Reduction Act (IRA) of 2022 – The Starting Point

Passed in 2022, the IRA marked the most significant climate legislation in decades. It introduced a broad package of clean-energy incentives spanning solar modules, cells, thermal systems, and energy storage. Among its centerpiece features was the introduction of technology-neutral credits—the Clean Electricity Investment Tax Credit (CEITC) and Clean Electricity Production Tax Credit (CEPTC)—replacing the legacy ITC and PTC for solar.

The IRA also created bonus adders, including a 10% domestic content bonus for U.S.-made steel, iron, and manufactured products, plus extra credits for projects in energy or low-income communities. Its goals extended beyond cost savings to reducing fossil fuel reliance, stabilizing energy prices, and driving long-term decarbonization.

Enter the One Big Beautiful Bill (OBBBA)

The OBBBA, enacted in July 2025, significantly refines and accelerates these frameworks. It introduces earlier phase-outs for wind and solar, raises domestic content thresholds, and implements tougher compliance and documentation rules that developers must navigate carefully.

Key Domestic Content Changes:

- OBBBA raises the domestic content bonus thresholds in a phased manner:

- 45% for projects beginning construction after June 16, 2025

- 50% in 2026

- 55% for projects starting in 2027 and beyond.

This structure corrects a drafting oversight in IRA that had fixed ITC domestic content at 40%, misaligned with CEPTC. OBBBA ensures parity across credit types.

Phasing Out Tax Credits

Wind and solar face an accelerated phase-out under OBBBA:

- Full phase-out: The §45Y PTC and §48E ITC end for facilities placed in service after December 31, 2027.

- Safe-Harbor Update (Sept 2025): Under IRS Notice 2025-42, the traditional 5% Safe Harbor has been eliminated for all wind and for solar projects over 1.5 MWac. Going forward, only the Physical Work Test qualifies as “beginning of construction,” with a narrow exception for small solar ≤1.5 MWac.

- July 4, 2026, deadline: Projects must have begun construction (via Physical Work Test) before this date to extend their window; otherwise, they must be placed in service by year-end 2027.

- Other technologies: Geothermal, storage, and similar resources continue on the IRA’s longer phase-down, starting in the early 2030s.

Why this matters: While technically possible to qualify in early 2026, the risk is drastically higher. Developers face both FEOC compliance burdens and the loss of Safe Harbor flexibility. 2025 is the safe year to lock in credits with certainty.

Restructured Compliance Pathways

The law introduces stricter oversight:

- Foreign Entity of Concern (FEOC) rules apply to ownership structures and licensing arrangements. Projects tied to restricted entities risk losing credit eligibility entirely.

- Documentation requirements for the beginning of construction and domestic content have been tightened, with limited safe-harbor options remaining.

Key Features of the Big Beautiful Bill Solar Investment Tax Credit

The bill reshapes renewable project development through a combination of streamlined incentives, domestic sourcing rules, and stronger oversight.

Rather than scattering credits across dozens of tax codes, the bill organizes them into modernized provisions:

- Section 48E ITC (Clean Electricity Investment Tax Credit) – replaces the legacy ITC, covering solar systems, storage projects, and hybrid facilities. Its base credit is 6% of qualified investment for eligible clean electricity and storage projects placed in service after December 31, 2024.

- Section 45Y PTC (Clean Electricity Production Credit) – rewards ongoing generation from qualified facilities. While specific base rates vary, similar stackable bonuses apply (e.g., domestic content, wages).

- Section 25D Residential Clean Energy Credit – supports residential rooftops, lowering homeowner electricity rates.

- Section 45Q Carbon Oxide Sequestration Credit – incentivizes carbon oxides capture and carbon oxide sequestration.

- Section 45V Clean Hydrogen Production Credit and Section 45U Zero-Emission Nuclear Power Production Credit – expand support for advanced clean energy sources.

- Section 45Z Clean Fuel Production Credit and Section 45X Advanced Manufacturing Production Credit – encourage clean fuel production tax credits and domestic manufacturing of eligible components.

Together, these energy tax provisions strengthen U.S. competitiveness in renewables, hydrogen, nuclear, and manufacturing.

Financing Options

Although policy shifts have tightened eligibility, key financing mechanisms remain:

- Solar leases and Power Purchase Agreements (PPAs) still provide flexible, long‑term structures.

- Publicly Traded Partnerships (PTPs) continue to attract capital under the stabilized tax environment.

- Transferability of credits—a vital monetization tool especially for tax‑exempt or early‑stage developers—was preserved in the final bill, despite initial House proposals to eliminate it.

However, stringent FEOC documentation and compliance may raise due diligence costs.

Oversight Roles

Responsibility is shared across agencies:

- Treasury/IRS: Administers credit eligibility, reporting, and registration.

- Department of the Interior: Balances land approvals for solar and renewable projects with landscape protections.

- Executive Branch: Enforces FEOC rules and implements broader clean energy strategy.

Why This Matters for California Businesses

For California’s C&I property owners, the stakes are high. The state faces persistently high electricity rates, recurring grid reliability issues, and aggressive decarbonization goals. Acting in 2025 offers three major benefits:

- Lower costs: Federal credits reduce upfront expenses. Stand-alone storage now qualifies under §48E, and meeting domestic sourcing rules can add up to 10 percentage points in bonus credits.

- Greater resilience: Storage-backed systems keep critical loads powered during outages and reduce costly demand charges.

- Reduced risk: Starting projects in 2025 avoids FEOC uncertainty and secures eligibility before Safe-Harbor restrictions narrow further in 2026.

Challenges and Criticisms

The Big Beautiful Bill solar investment tax credit is ambitious, but no policy of this scale escapes scrutiny. Industry leaders, policymakers, and businesses have raised concerns about execution and long-term viability.

Supply Chain Pressures

Developers welcome the emphasis on U.S.-manufactured content, but meeting these thresholds is difficult. According to the U.S. Geological Survey, America is 100% import reliant for 12 of 50 critical minerals and more than 50% reliant for another 28, including lithium, cobalt, and rare earth elements that underpin solar and storage technology. Meanwhile, the International Energy Agency reports that China controls over 80% of global capacity for polysilicon, wafers, cells, and modules, making domestic substitution a long-term challenge.

Market Concerns and Project Economics

The domestic-content bonus can be lucrative — worth an extra 10 percentage points on the ITC or a 10% multiplier on the PTC — but smaller developers face hurdles documenting compliance and absorbing cost increases. Interconnection costs, especially transmission upgrades, now account for the majority of withdrawals from grid queues. Industry associations like the Solar Energy Industries Association (SEIA) argue that without transitional support, these measures could limit competition and stifle growth in regions where domestic sourcing isn’t yet available.

Policy Uncertainty

IRS and Treasury are still clarifying terms such as “effective control,” “eligible components,” and the Material Assistance cost ratio. Guidance has shifted multiple times since mid-2025, including Executive Order 14199 directing Treasury to curtail “market-distorting subsidies” and accelerate sunsets for certain credits. Developers must also track beginning-of-construction safe harbors, updated under Notice 2025-42, which now carry heightened significance for financing. Shifting interpretations can undermine investor confidence, as long-term financing relies on predictability.

Carbon and Broader Climate Policy

Another source of debate is how the bill interacts with climate strategies such as a potential carbon tax, credits for carbon oxide sequestration, and incentives for clean fuel production. Critics worry about fragmented implementation—without a clear hierarchy, businesses must hedge investments across multiple technologies like solar projects, hydrogen, and carbon capture, unsure which will ultimately dominate.

Market Implications Beyond Solar

Although centered on the solar industry, the Big Beautiful Bill has ripple effects across the broader energy and infrastructure landscape.

- Electric Vehicles & Transportation: EV adoption benefits from charging infrastructure tied to §48E credits.

- Data Centers & Energy-Intensive Loads: Storage incentives stabilize demand amid surging AI and industrial electrification.

- Utility-Scale Renewables: The §45Y PTC supports diversification into wind, geothermal, and hybrid projects.

- Carbon Management & Emerging Tech: §45Q and §45V credits open cross-sector pathways in carbon capture and hydrogen.

- Financing Innovation: Publicly Traded Partnerships and credit transferability remain, though investors must now navigate stricter FEOC and compliance rules.

Conclusion

There seems to be a turning point in U.S. renewable energy policy with the introduction of the Big Beautiful Bill solar investment tax credit. Rather than simply extending existing incentives, it reshapes the landscape through clearer structures, tougher compliance, and a broader reach that touches everything from solar projects and energy storage technology to clean fuel production and carbon management.

But the message for California businesses is clear: 2025 is the safest year to act. Waiting until 2026 exposes projects to stricter FEOC rules and the loss of Safe Harbor flexibility, creating real risk for financing and eligibility.

For those who move quickly, the Big Beautiful Bill offers more than credits—it delivers a roadmap toward energy cost savings, resilience, and leadership in the clean energy transition.

Take the Next Step with Revel Energy

At Revel Energy, we can help California businesses cut costs, strengthen resilience, and fully capture incentives under the Big Beautiful Bill. From solar development and energy storage integration to tailored PPAs, our team ensures your project is designed for immediate savings and long-term success.

Reach out today to secure your project before the 2026 FEOC deadline—and maximize certainty in this rapidly evolving energy market.

It is a restructuring of U.S. clean energy incentives that consolidates credits under Section 48E ITC, Section 45Y PTC, and others. It introduces stricter domestic content requirements, ownership restrictions, and oversight by the Treasury Department and the Department of the Interior.

The Inflation Reduction Act created broad energy tax credits. The Big Beautiful Bill refines them, expands energy tax provisions, and adds enforcement mechanisms such as Material Assistance Restrictions.

Qualified facilities include solar projects, utility-scale renewable energy projects, storage projects, and residential rooftops. Projects tied to foreign entities of concern may face restrictions.

To receive maximum credit, projects must meet escalating domestic sourcing thresholds (45% in 2025, 50% in 2026, 55% in 2027). Non-compliance reduces benefits.

Leases and PPAs remain effective financing tools, though stricter FEOC and documentation requirements affect structuring.

PTPs can participate in renewable financing, broadening capital access.

Because beginning construction after July 2026 risks disqualification, and as of Sept 2025, the 5% Safe Harbor is gone for large projects. FEOC compliance is also tightening, making 2025 the safest year to lock in eligibility.

By driving solar, storage, and grid modernization, the bill aims to stabilize and lower costs over time, offsetting California’s high energy rates.

ROOFTOP SOLAR

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

ENERGY STORAGE

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

EV CHARGING STATIONS

As the popularity of EVs increase, so does the demand for on-site EV charging stations. This sustainable amenity has become a parking lot fixture for employers.

CREATING CAPITAL THROUGH SUSTAINABILITY, WE OFFER:

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

ENGINEERING, PROCUREMENT, CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.