2024 Updates to Net Billing (NEM 3)

Solar energy solutions in California continue to evolve, and August 2024 updates in to the state’s Net Billing (NEM 3) program are making it clear – businesses considering solar should act sooner rather than later.

The California Public Utilities Commission (CPUC) has made additional changes to the Net Billing Tariff (NBT) under NEM 3.0, which further reduce the value of solar energy that businesses send back to the grid. This update, finalized in August 2024, underscores the importance of taking immediate action for companies looking to maximize their solar investment.

The Latest Changes to Net Billing Tariff (NBT)

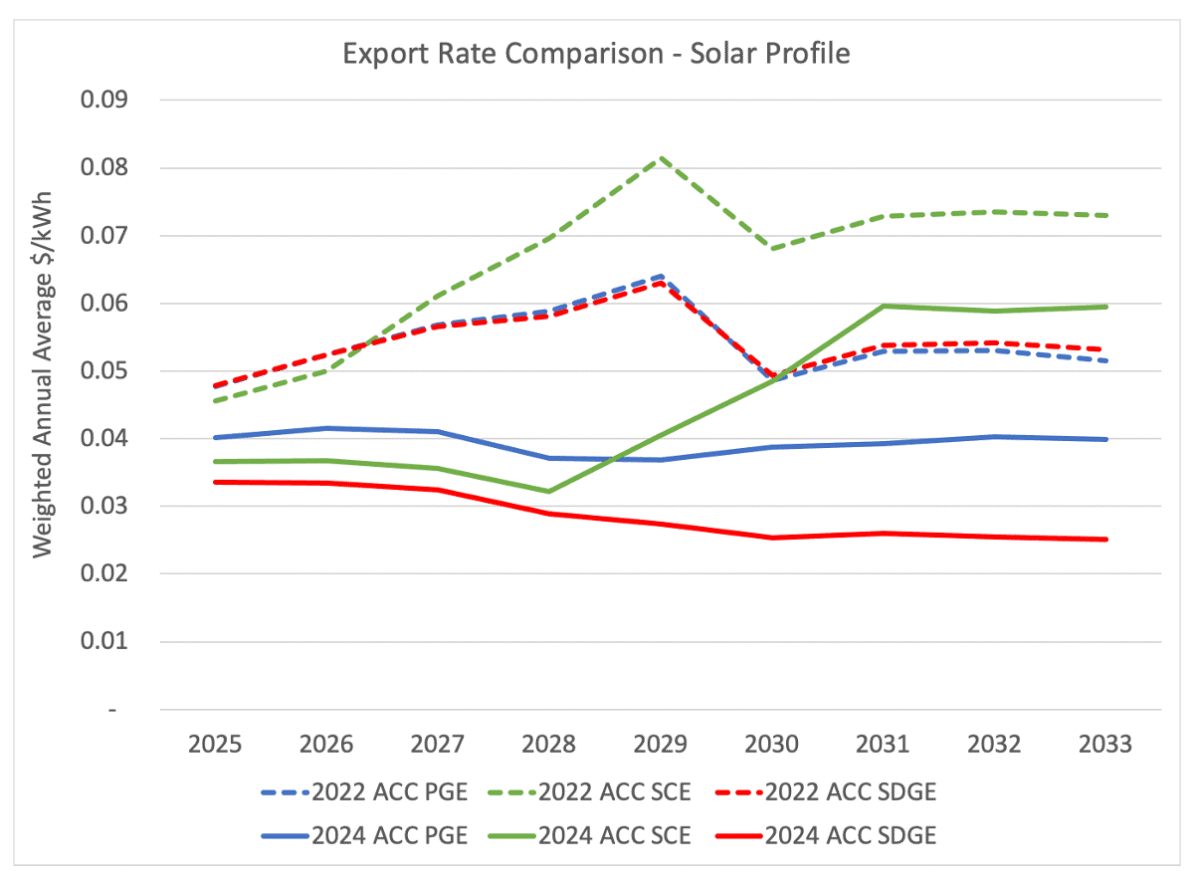

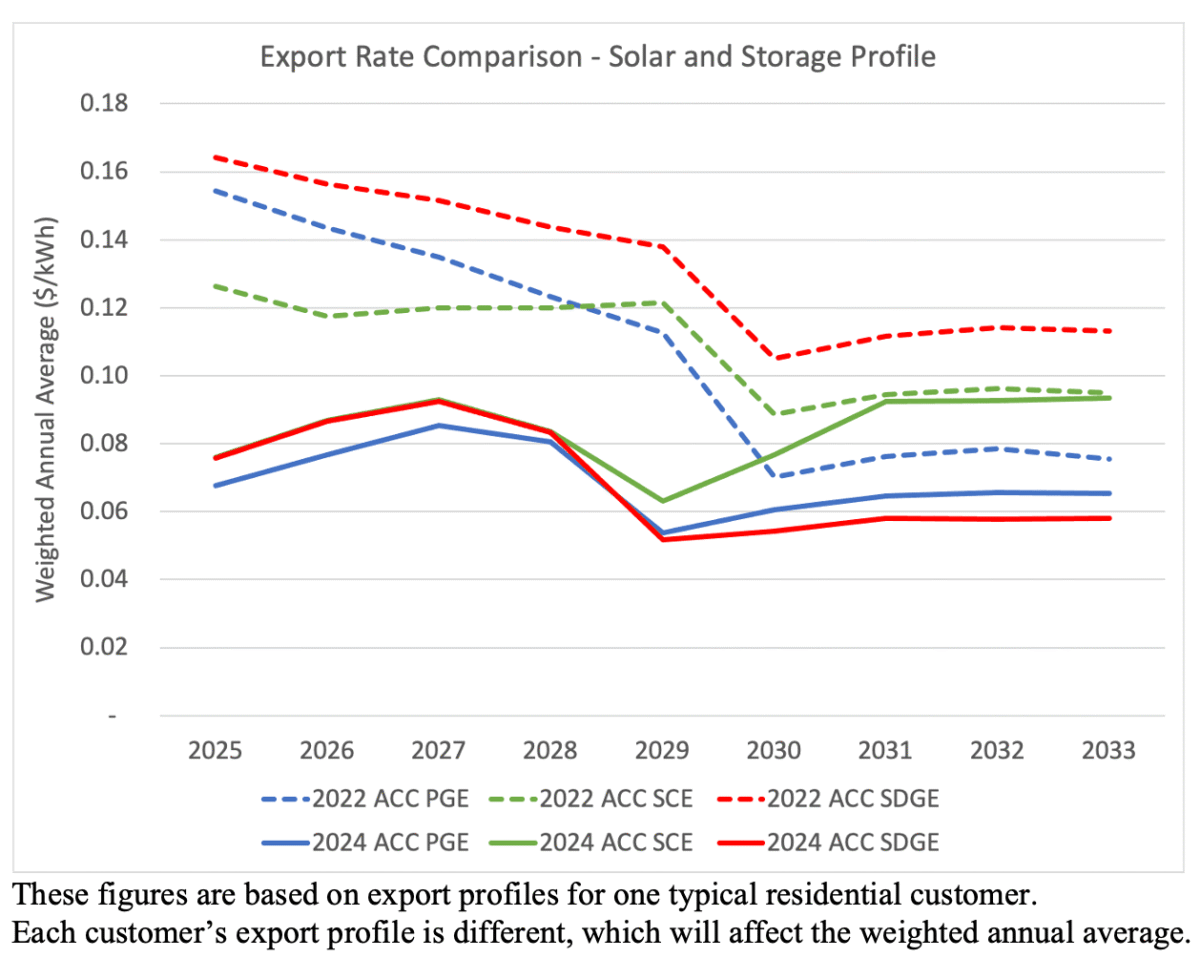

The most significant aspect of the latest CPUC update revolves around the Avoided Cost Calculator (ACC). This calculator determines the rates at which businesses are compensated for excess energy sent back to the grid. Under this recent change, the export rates for systems that interconnect in 2025 and 2026 will be even lower than before, diminishing the value of solar energy during high-demand hours, and further reducing the economic return on investment (ROI) for future solar installations.

These export rates, which have been steadily declining, affect businesses’ ability to recoup costs through grid contributions. The new ACC methodology assumes that utility spending will continue to rise at an uncontrollable rate, contributing to the declining value of solar energy in the calculation. This creates a scenario where solar energy is undervalued despite its proven long-term potential to reduce overall utility costs.

Businesses that have already installed systems or that interconnect by the end of 2024 will retain the previous ACC export rates for nine years. However, those who wait beyond this deadline will be subject to the new, significantly lower export rates from day one.

Why Businesses Benefit From Acting Now and Installing Commercial Solar

As a business owner considering solar energy, timing is everything. The CPUC’s 2024 updates to Net Billing (NEM 3) make it clear that the value of energy exported to the grid will continue to decrease over time. This means that the longer businesses wait to install solar, the less they will earn for the excess energy they send back to the grid. While the changes are primarily focused on systems installed after 2024, it’s crucial to note that the ACC, and consequently export rates, will continue to decrease annually, making future installations less financially advantageous.

Here are three key reasons why businesses should consider acting now:

- Higher Export Rates Now: Businesses that install solar by the end of 2024 will lock in current export rates for the next nine years. These rates, while not as high as pre-NEM 3.0 levels, are still significantly better than what will be offered for systems installed after 2024.

- Avoiding Future Cost Increases: The CPUC’s updated ACC is built on the assumption that utility costs will continue to rise. Waiting to install solar could mean facing even higher upfront costs and lower returns on investment in the future.

- Maximizing Self-Generation Benefits: While the export rates are declining, the value of self-generation remains high. By installing solar now, businesses can significantly reduce their reliance on utility-provided power, shielding themselves from rising energy costs. This is especially true during peak demand hours, when utility rates are at their highest.

The Changing Solar Landscape In California

It’s important to recognize that these changes are part of a broader trend in California’s energy policy. The state’s focus is shifting from small-scale, customer-sited solar installations to larger, utility-scale projects. This shift, combined with policies like the updated ACC, makes it clear that policymakers are not prioritizing the needs of businesses and individuals looking to invest in their own solar energy systems.

That said, CALSSA and other advocates continue to push back against these policies. They emphasize the importance of distributed energy resources, like customer-sited solar, in achieving California’s ambitious clean energy goals.

While advocacy efforts continue, businesses should not wait for policy reversals or improvements that may not come in time to protect their financial interests.

Contact Our Expert Team to Get Started Today

The CPUC’s recent update to the Net Energy Metering program further diminishes the value of solar energy for businesses in California. As the state updates Net Billing or NEM 3.0, businesses that are considering solar should act before the end of 2024 to lock in higher export rates and secure long-term financial benefits.

With utility rates expected to rise and the value of exported energy set to decrease annually, now is the time to invest in solar. By doing so, businesses can hedge against future cost increases and ensure they’re getting the most out of their investment before these changes take full effect. Don’t wait until 2025 – capitalize on the current rates and take control of your energy costs today.

Commercial Solar EPC & PPA Provider for California Businesses

For more information on equipping your manufacturing business with commercial solar, energy storage or EV charging stations. Your business may benefit from a power purchase agreements for renewable energy solutions, contact us today. Our expert team will provide your business with an obligation-free energy evaluation for your property.

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

As the popularity of electric vehicles increase, so does the demand for on-site charging. This sustainable amenity has become a parking lot fixture for competitive employers.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1106092

See how these businesses saved on electricity, gained valuable tax credits and rebates with commercial solar and energy storage.

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.

Arizona Rising Business Electricity Costs: The APS & TEP Impact (& Why July Matters)

If you run a manufacturing plant or heavy industrial facility

2026 Business Electricity Costs: Why Companies Are Pivoting

If you are a CFO or facility owner in California,

How Businesses Are Turning 2025 Tax Bills into Solar Assets

A new way to look at commercial solar: not as

Rising Electricity Rates, Shrinking Incentives: Why 2025 Is Critical for California Businesses to Go Solar

California businesses entered Q4 2025 paying some of the highest

The Solar Tax Credit Is Ending Soon: Last Chance to Save 30%

Wondering when the solar tax credit ends? For millions of

Solar Investment Tax Credit for Businesses: 2025 Incentives

The Federal Solar Investment Tax Credit (ITC)—codified under Section 48E—remains