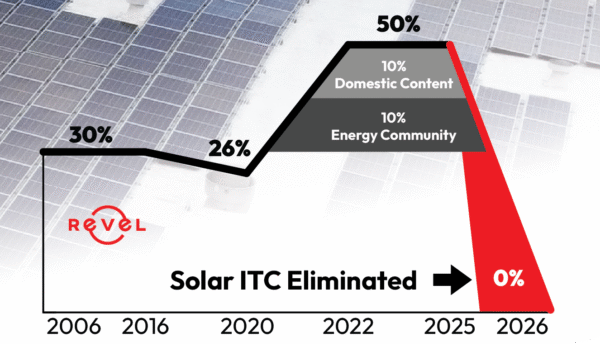

Act now to lock in the 30%–50% Federal Solar Investment Tax Credit before it disappears.

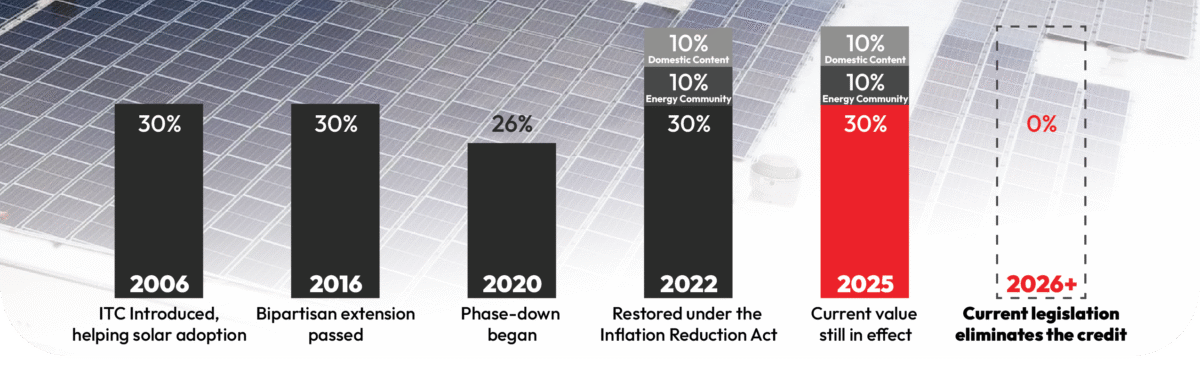

For nearly 20 years, the Federal Investment Tax Credit (ITC) has been a cornerstone incentive helping U.S. businesses adopt commercial solar and energy storage. But with recent legislation passed by the House of Representatives, that benefit is now on the chopping block.

If the Senate passes the bill as written, the ITC will be eliminated altogether, and businesses will have just 60 days from the signing date to initiate a solar project to preserve their eligibility. Inaction now could mean missing out on one of the final and most lucrative clean energy incentives in U.S. history.

Solar Isn’t Just About Savings – It’s a Competitive Advantage

For business owners who operate in high-cost electricity markets like California, the 30% Federal ITC—plus additional 10% bonuses for using domestic content or building in qualified energy communities—can significantly accelerate return on investment.

When paired with accelerated depreciation (including 60% bonus depreciation in 2025), these projects frequently offset hundreds of thousands of dollars in taxes and reduce operating costs from day one.

But it’s more than that: commercial solar gives you a structural cost advantage over competitors. While others remain exposed to unpredictable utility rate hikes, solar adopters lock in predictable, long-term electricity costs. That’s a built-in hedge against inflation and a powerful tool for boosting net operating income and asset value.

This moment mirrors the 2019 ITC stepdown, when businesses rushed to secure projects before the credit dropped from 30% to 26%. But this time, it’s even more urgent: the proposed legislation would eliminate the credit altogether, making commercial solar significantly less tax-efficient overnight.

The 60-Day Window: What You Must Do to Qualify

The good news: to qualify under existing rules, your business doesn’t need to complete the project—just initiate it. That means signing a contract and either beginning physical work or making a qualified equipment purchase to establish “safe harbor” status.

Revel Energy can help move quickly. As a full-service EPC and solar project developer, we handle:

- Site evaluation and project scoping

- Solar + storage system design

- Tax strategy consultation with ITC and depreciation modeling

- Safe-harbor documentation and deadlines

This window is rapidly closing. If the Senate passes the bill—likely within weeks—the 60-day countdown begins. Without action, the 30%–50% tax benefit disappears.

Source: Utility Dive – IRA Tax Credits at Risk in Trump-Backed Budget Bill

A Call to Action for Business Owners—and Citizens

This proposal threatens one of the few reliable federal incentives available to reduce emissions and help businesses modernize their infrastructure. Whether or not you’re planning to go solar now, this issue affects your energy costs, your taxes, and the future of clean technology.

We encourage you to contact your U.S. Senators and ask them to oppose the ITC repeal. Tell them:

- Businesses deserve long-term, stable incentives to plan major capital projects

- Removing the ITC undermines American energy independence and domestic manufacturing

- You support keeping the 30% solar ITC and accelerated depreciation in place

Find your representatives here: www.senate.gov/senators/senators-contact.htm

Secure Your Project While You Still Can

Even if you’re only considering solar, a quick consultation with our team could lock in your tax credit eligibility. Missing this deadline could extend your project payback from 3–5 years to 6–8 years or more—still a valuable investment, but with far less financial upside.

Revel Energy has guided California businesses through every shift in energy policy since 2017. Our mission remains the same: to create capital through creative energy solutions—and to protect our clients from rising costs and shrinking incentives.

Let’s preserve your tax credit and your energy future.

Contact us now or call (949) 281-7171 to schedule a fast, no-pressure consultation.

ROOFTOP SOLAR

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

ENERGY STORAGE

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

EV CHARGING STATIONS

As the popularity of EVs increase, so does the demand for on-site EV charging stations. This sustainable amenity has become a parking lot fixture for employers.

CREATING CAPITAL THROUGH SUSTAINABILITY, WE OFFER:

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

ENGINEERING, PROCUREMENT, CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.