The Solar ITC Step Down & Safe Harbor Explained in Video

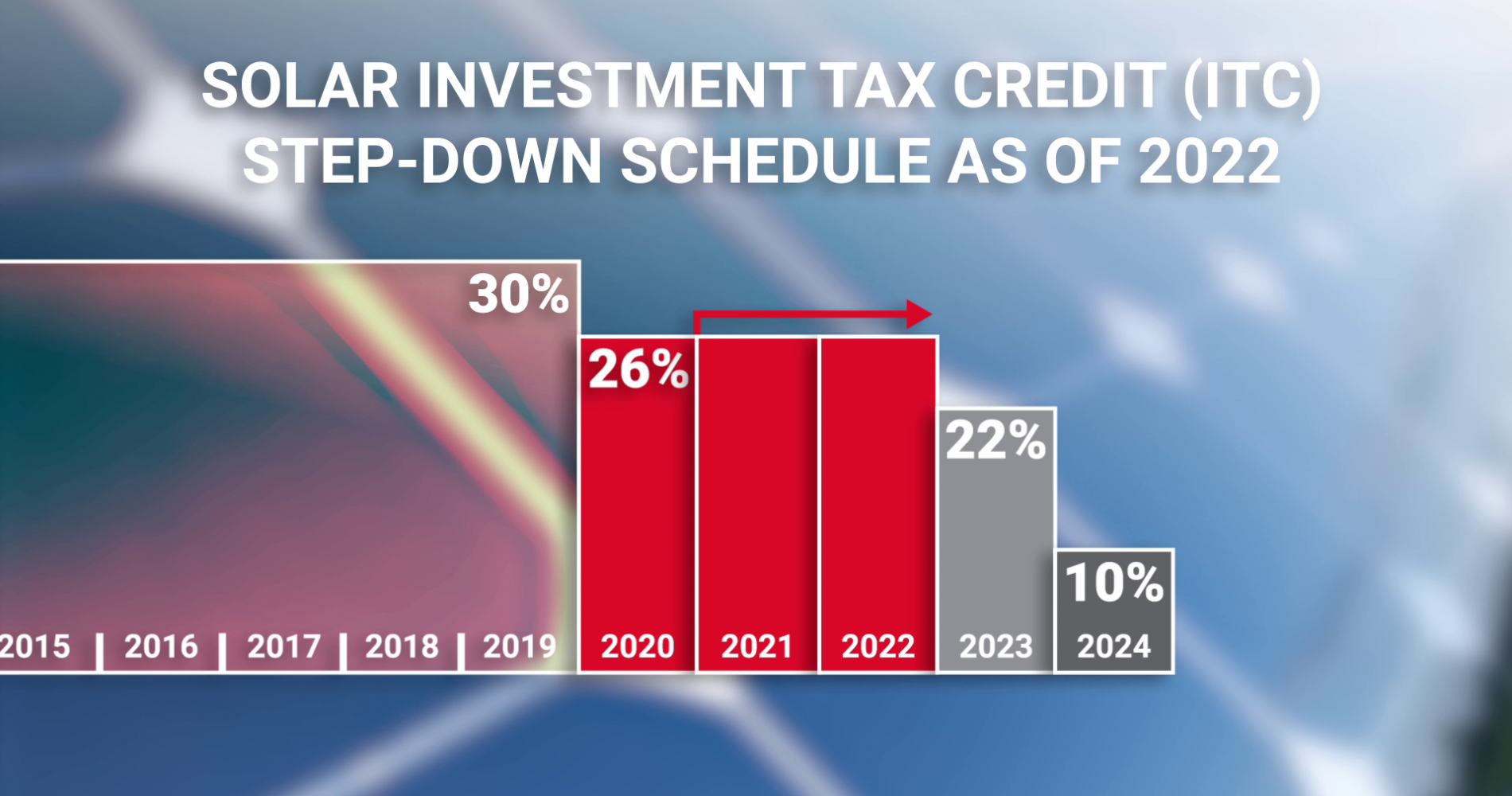

The Solar Investment Tax Credit (ITC), currently valued at 26%, is scheduled to step down to 22% in 2023, this video explains there is still time to for your business to safe harbor these savings for an agricultural, commercial or industrial solar system.

Highlights:

- The 2022 ITC rate is 26%

- Stepping down to 22% Jan. 1, 2023

- Safe Harbor is available for 26%

- Soft deadline is Dec. 15, 2022

- “Dollar-for-dollar” tax credit

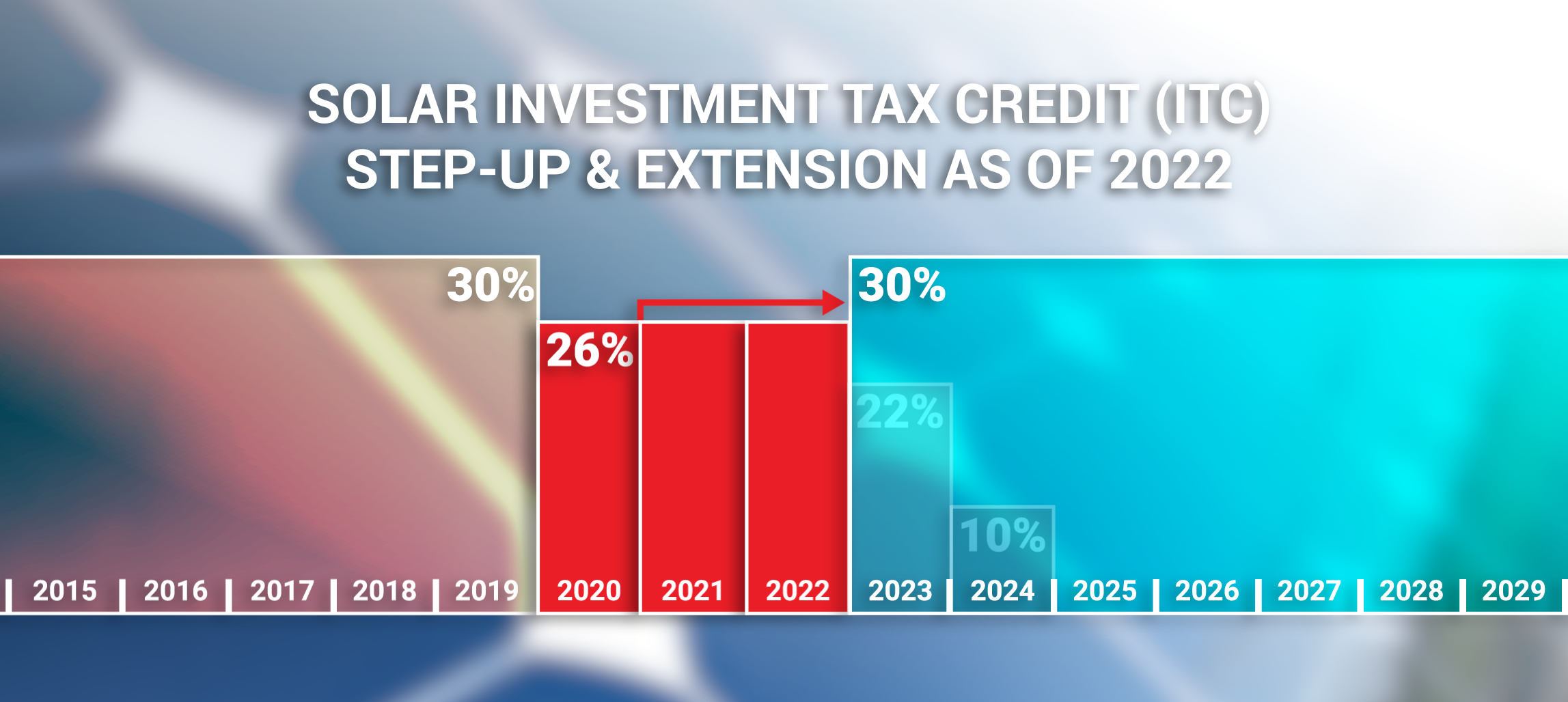

Solar Investment Tax Credit Potential Extension and "Step-Up"

Currently, there are proposals to increase the solar ITC back to its original 30% and extend the program for up to 10 years. There are many legislative steps ahead of this industry catalyst, but agricultural, commercial and industrial solar installations completed in the same year this legislation is considered would have no issue safe harboring the full 30%.

The Solar ITC Faces A Scheduled Step Down

Previously valued at 30% from 2006 until Jan 1, 2020, the solar ITC followed its scheduled step down in 2020 to 26% and remained for 3 years after the federal government extended the 26% term. As it currently stands, the scheduled step down to 22% will occur at the end of 2022. An important deadline date is December 15, 2022, keep this date in mind as we discuss it further.

The solar ITC is a dollar for dollar tax credit for businesses that invest in solar. Agricultural, commercial and industrial solar enable businesses to lower operating expenses by reducing constantly rising electricity costs, putting valuable cash back into the business.

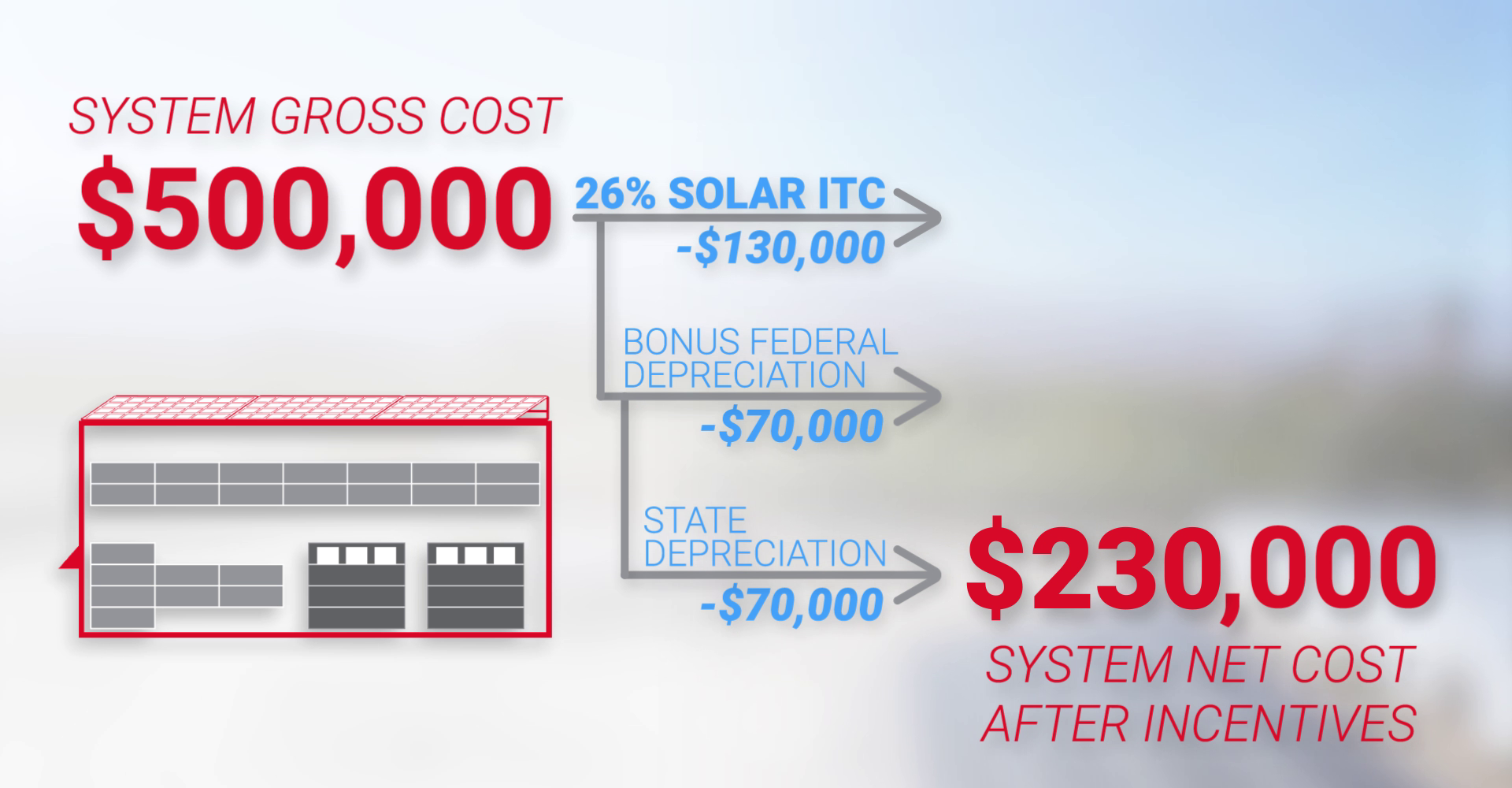

It is important to note that your business can use the tax credit spread out over a number of years. This is a major incentive for commercial solar that can be combined with other programs and incentives like state and federal bonus depreciation to further reduce system costs and provide more value to businesses through sustainability.

Example of How Businesses Save with the Solar Investment Tax Credit

As an example, for a business investing in solar for $500,000, the solar ITC value would be worth $130,000 in actual tax credits. Factoring in additional programs and incentives the net cost is often reduced by more than half, in our example to $230,000. Solar provides significant electricity bill savings throughout the life of the system, providing protection from a certain future of rising energy costs. Systems similar to this example can provide $5,000 monthly bill savings, or $60,000 annually.

This is a very real example of how businesses have invested in solar installations that pay for themselves within 3 – 5 years, then these systems provide serious ROI throughout 25 years of rising energy rates from the utility. Agricultural, commercial and industrial businesses are more competitive with solar with reduced operating costs. As the solar ITC has already stepped down from 30% to 26%, it is critical to take advantage of this significant 4% savings.

Safe Harbor the Solar ITC

There’s still some time to lock in that 26%, thanks to the IRS establishing a provision to the ITC called “safe-harbor”. Safe-harboring is designed to allow customers to preserve the ITC of that year by starting construction before the year ends. The definition of starting construction is the key to safe-harbor:

If you incur and pay 5% of your total project’s cost, before January 1st, 2023 – you have started construction and can still take that 26% tax credit. In case the ITC is extended and boosted to 30%, safe harbor rules still apply resulting in a bonus 4% savings.

Starting construction can be as simple as procuring equipment for your project. An example is ordering the solar panels for your system.

There must be a reasonable expectation that the equipment will be delivered within 3 ½ months– this is referred to as the 3.5 rule.There is some urgency when it comes to scheduling. Businesses are asked to make their deposit by December 15th at the latest in order for developers like Revel Energy to procure equipment within the 3.5 rule guidelines.

Californians pay some of the highest electricity rates in the country, and prices are consistently rising to pay for the dilapidated grid. Claim energy independence for your business and take advantage of the significant savings the solar investment tax credit offers. Contact a Revel Energy Solar Specialist today to see how your business can safe harbor the solar ITC before another step down, as explained in our video above.

About Revel Energy

Revel is on a mission. Dedicated to renewable energy solutions since 2009, Revel Energy was formed to provide Commercial, Industrial and Agricultural businesses with alternative energy beyond solar. Revel stands out from the competition by paying attention to what makes good business sense to each individual client, implementing a wider range of technologies to free up capital and make businesses sustainable and more profitable.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.

ROOFTOP SOLAR

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

ENERGY STORAGE

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak hour charges

LED LIGHTING RETROFIT

Generating independent solar power is one piece of the puzzle. Energy saving equipment like highly efficient LED Lighting completes the system. Significantly reduce energy usage.