Lock In My Solar ITC

Highlights – Lock in the Solar Investment Tax Credit (ITC):

- 5% Non-refundable deposit by 12/1/22

- Equipment cost incurred (funds from deposit) by 12/31/22

- Equipment must have reasonable lead time max 3.5 month

- 2023 steps down to 22%

- 2021 Q2 electricity rate are expected to hit historical highs again

HOW TO LOCK IN THE 26% SOLAR ITC

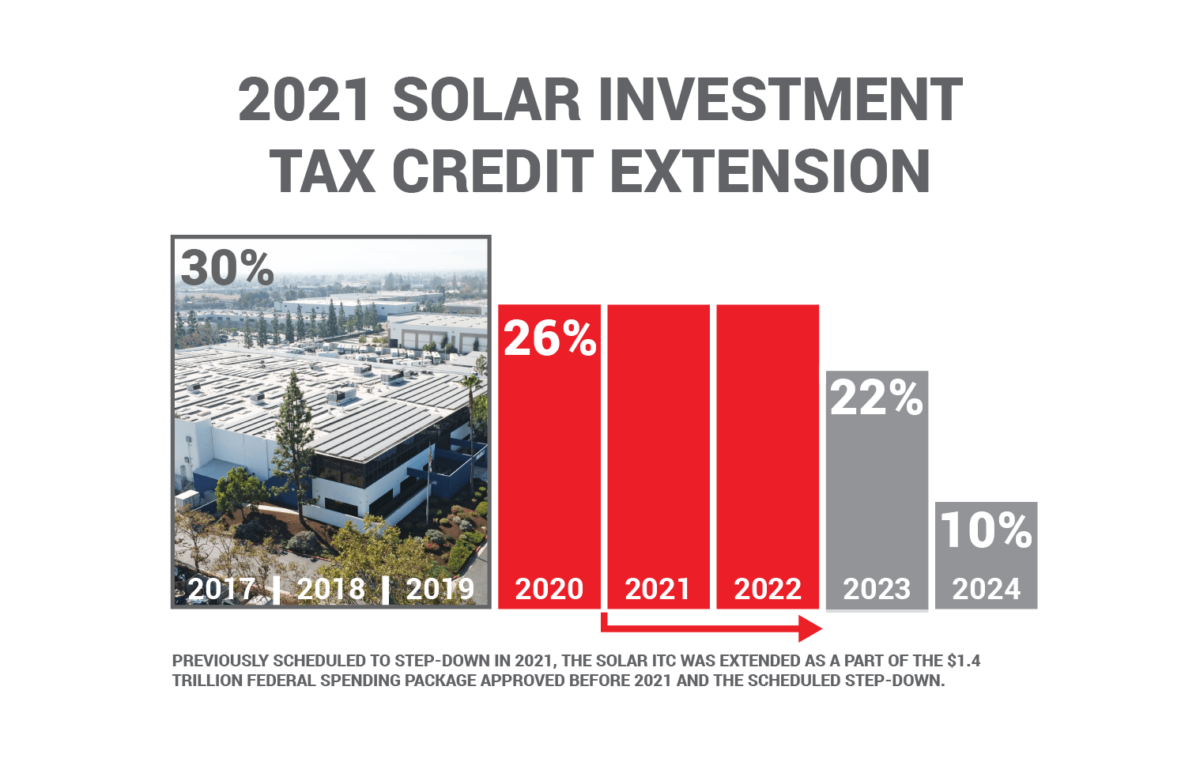

Locking in your 2021 Solar ITC rate will save your business thousands of dollars. The 2023 ITC is scheduled to stepdown 4 percentage points to 22% (10% for 2024). Locking in your 26% solar investment tax credit is simple but getting started right away with a comprehensive energy evaluation is important for timeline purposes. More and more California businesses have realized the value of solar, recently, California briefly ran on 100% renewable energy with solar providing two-thirds of that supply.

As per IRS Notice 2018-59, any business “beginning construction” in 2020 is eligible for the 26% rate. There are two options to qualify. The business must either pass the “Physical Work Test” by accomplishing significant physical work on the system or pass the “Five Percent Test” by paying or incurring 5% costs of the total system’s price tag.

“For most types of energy property, eligibility for the ITC, and in some cases the amount of the ITC for which energy property is eligible, are dependent upon meeting certain deadlines for beginning construction on the energy property and placing the energy property in service. The table below summarizes these requirements.” -Section 48, IRS Notice 2018-59

2020 Amendment to the Rule as Per section 45 and 48 of the Code: Equipment costs must be paid or incurred before year-end, there must be a reasonable expectation that the equipment will be delivered within 3.5 months.

Because of this rule, Revel Energy recommends getting your deposit in by Dec 1, 2022 to ensure enough time to “safe harbor” your 26% Solar ITC.

Both options have their fine print and Revel Energy is not a tax professional. We always recommend consulting your tax expert for more details.

The “Five Percent Test” may be the clearest and most measurable option of the two. Five percent can be paid in the form of a non-refundable deposit. Keep in mind with a 2023 step down delta of 4 percentage points that is almost the non-refundable deposit right there.

The “3.5 Month Safe Harbor Rule” is used to qualify you for the 2021 ITC rate by your contractor or developer procuring qualified equipment for the project with a reasonable lead time of delivery within 3.5 months of the order. The order must be placed before 1/1/22. **if a delivery is affected by covid-19, the order may still be considered “reasonably within the 3.5 month rule.”**

*Revel Energy recommends making a 7-10% deposit towards your project. This does not raise you net price but guarantees at least 5% of deposit is used for items qualified for the “Five Percent Test.” For more information consult a Revel specialist.

![]()

Business owners that meet either of these requirements can benefit from the full 26% ITC if they continue to make “consistent progress” and complete the installation by 2023. It is important to work with an EPC or Project Developer that has a history of completing commercial grade projects on time.

CONCLUSION

Revel Energy works with many local businesses and property owners to help receive their best ROI on a commercial solar system. The Solar ITC is an integral part of most purchases. Revel’s team of commercial solar specialists can help identify potential eligible projects. Solar investors that make prudent moves now can save large sums on the backend ultimately improving their investment returns.

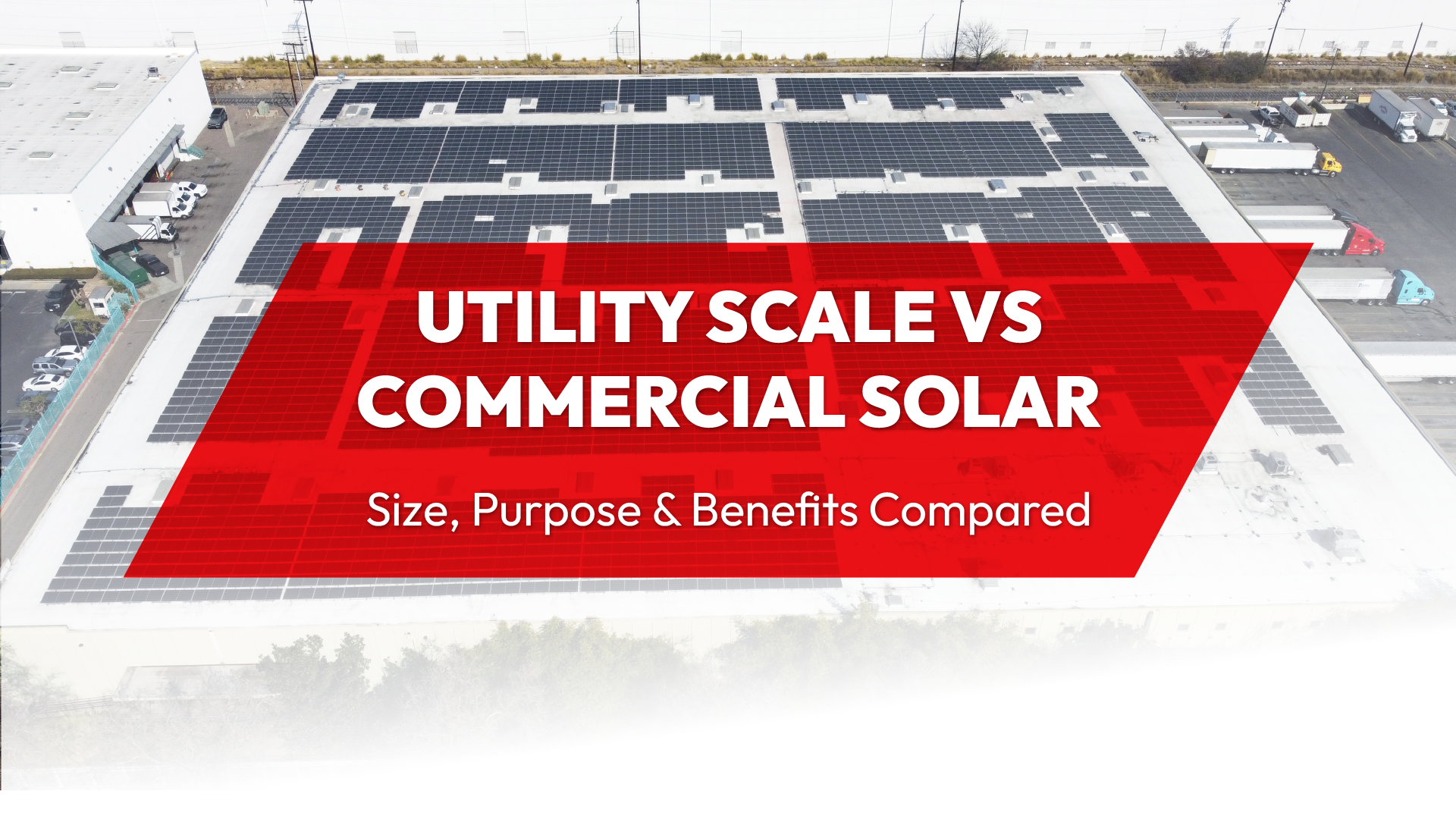

ROOFTOP SOLAR

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

ENERGY STORAGE

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak hour charges

LED LIGHTING RETROFIT

Generating independent solar power is one piece of the puzzle. Energy saving equipment like highly efficient LED Lighting completes the system. Significantly reduce energy usage.

Revel is on a mission. Dedicated to renewable energy solutions since 2009, Revel Energy was formed to provide Commercial, Industrial and Agricultural businesses with alternative energy beyond solar. Revel stands out from the competition by paying attention to what makes good business sense to each individual client, implementing a wider range of technologies to free up capital and make businesses sustainable and more profitable.

OUR SERVICES

TURNKEY COMMERCIAL GRADE SOLAR, ENERGY STORAGE, LED LIGHTING AND MORE.

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

CONSTRUCTION & INSTALLATION

CSLB #1038433

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.