Case Study On The Solar Investment Tax Credit

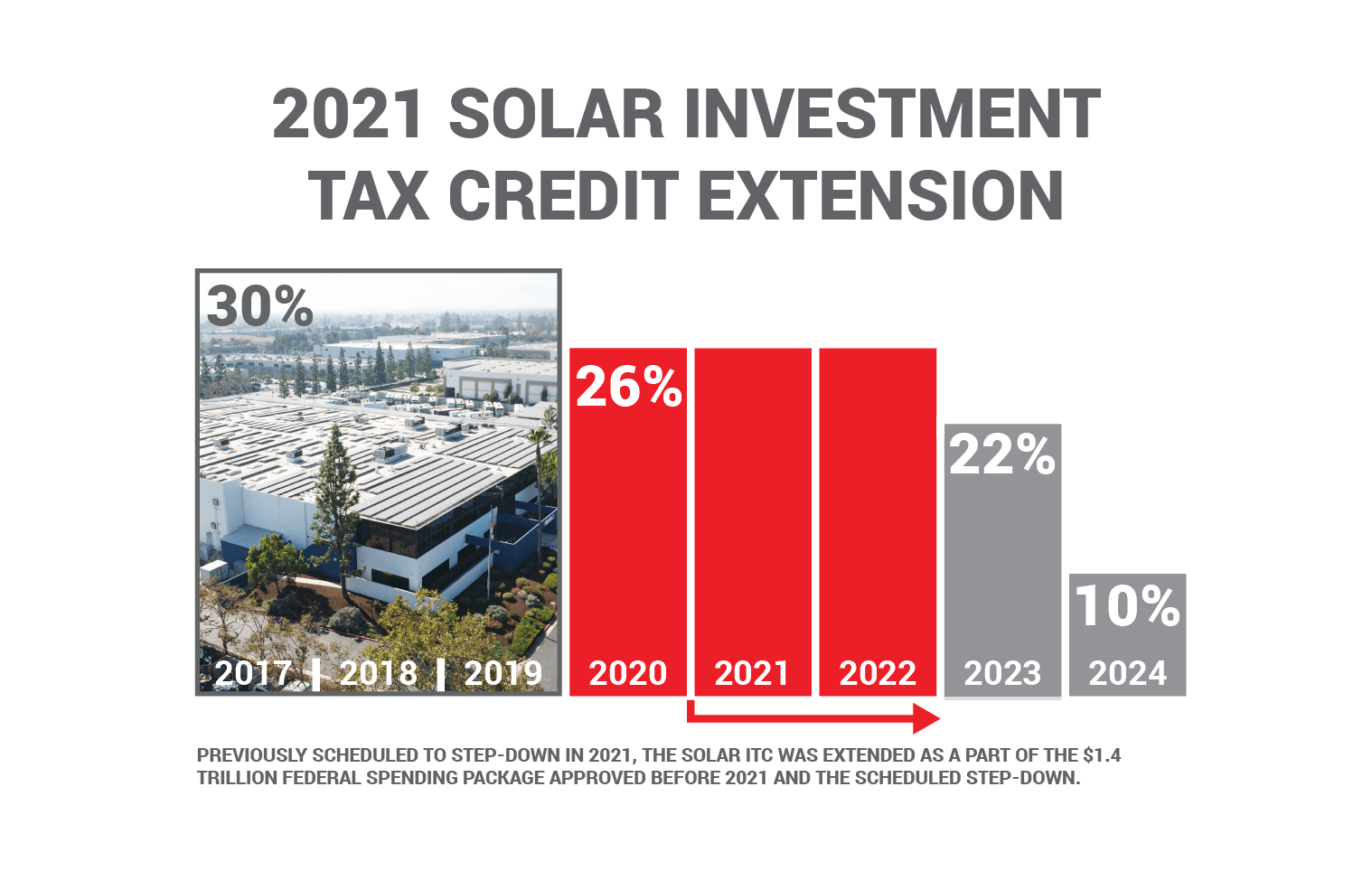

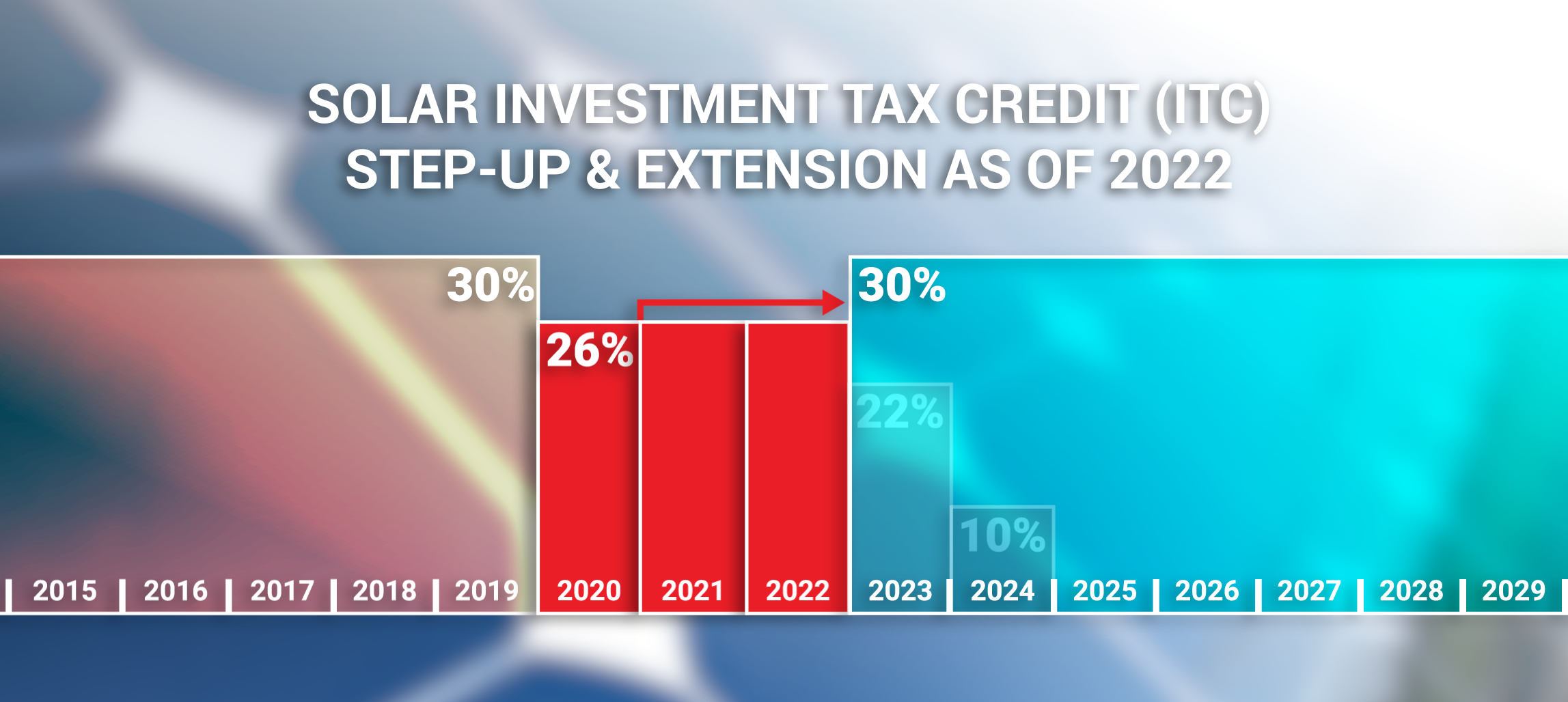

Case Study – The Solar Investment Tax Credit or Solar ITC, is the longest standing, and most well known incentive available for solar energy in the United States. Passed in 2005, the Solar ITC was expected to only last until 2007. Thanks to its popularity and success supporting the US transition to renewable energy, decision-makers have extended the expiration of this program multiple times.

The tax credit was a catalyst for the industry providing a 30% tax credit towards the cost of a new solar PV system for years, helping many businesses and homeowners access this proven technology.

After 2019, the value stepped-down to 26% for new systems in 2020 and planned another step-down to 22% for 2021 to plan for the program’s eventual phase-out. However, just before that step was taken, in December 2020 – congress extended the 26% phase of the step-down to last until the end of 2022.

Calculating the Solar ITC in 2021

Going forward in 2021, businesses that invest in solar earn a 26% tax credit based on the gross price of their system (i.e. a $500k system = $130k tax credit). The tax credit is a dollar for dollar credit.

For a more tangible example, here’s how one solar user benefited from the 26% tax credit. Revel designed and installed a medium-sized, solar-only solution that would generate over $4 million worth of energy over its lifetime and offset 40% of the manufacturing facilities’ daily electricity use.

The gross system cost came to about $500,000 meaning that this business was able to write off $150,000 ($130,000 in dollar-for-dollar tax credit alone) on their taxes filed in 2021, along with federal and state depreciation, the net cost was brought down to $350,000. The system pays itself off in only 3.5 years with the generated savings, and will generate positive cash flow for the remainder of the system’s life.

A Subsidy to Kick-Start an Industry

The Solar Investment Tax Credit has been a staple in commercial solar financing, shortening payback periods and generating positive cash flow with the cumulative electricity bill savings from the new solar PV system.

As solar technology has grown around the world, the overall cost per panel has dropped drastically. Governments, businesses and organizations looking towards a sustainable future recognize the value of solar, and the step-up it provides against competition.

Going Forward, What’s Next?

There is much speculation as to what the current administration will do with the Solar ITC. Many potential solar investors are hung up chasing “more lucrative incentives.” As it stands today, the 26% ITC is set to decrease at the end of 2022 down to 22%. There are currently no promises for an extension or any other type of structuring.

Every month that a business waits is another month of unnecessary electricity bills. These bills add up to negate any boost in incentives that may materialize in the future. The most reliable way to mitigate the payback period is to get started right away.

Taking Advantage of the Solar Investment Tax Credit

While the case study above outlines the potential benefits that the solar investment tax credit can provide, many business have already maximized their savings.

Electricity costs have risen significantly over the past few years, causing many commercial developers, property owners and facilities managers to look for ways to put cash back into their buildings and businesses.

Revel Energy has helped many businesses optimize these savings, designing each system to match the unique needs of any facility.

As more businesses evaluate the advantages and savings commercial solar and energy storage provide, take a step up on your competition and contact us today for a quote to see how much cash your business could save.

ROOFTOP SOLAR

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

ENERGY STORAGE

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak hour charges

As the popularity of electric vehicles increase, so does the demand for on-site charging. This sustainable amenity has become a parking lot fixture for competitive employers.

See how these businesses saved on electricity, gained valuable tax credits and significant rebates with commercial solar and energy storage.

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.