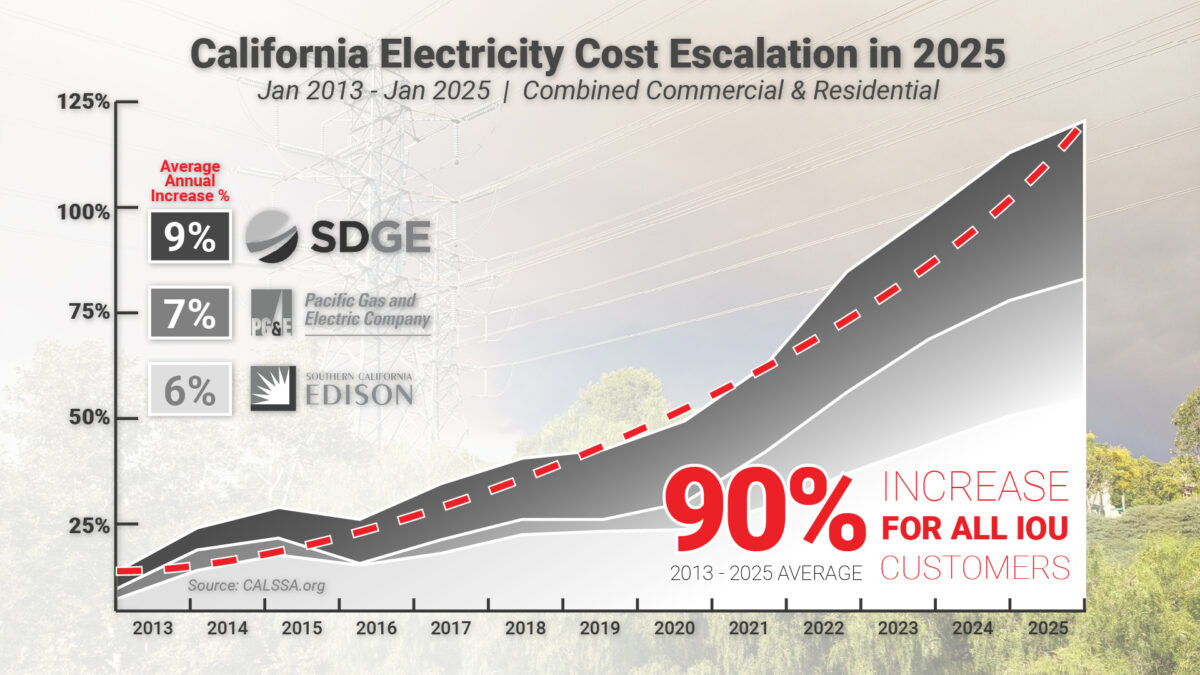

California businesses entered Q4 2025 paying some of the highest commercial electricity rates in the country. Federal data shows California’s average commercial electricity price at 29.31¢/kWh in August 2025 (up from 29.00¢ a year earlier), far above most states and well above national norms.

Across the state’s big three investor-owned utilities, the structural trend is the same: large grid budgets and policy shifts are finding their way into bills. Southern California Edison has posted new increases effective October 1, 2025, citing CPUC-approved revenue requirements. San Diego Gas & Electric has begun layering fixed monthly Base Service Charges onto residential bills under AB 205, a sign of utilities seeking more guaranteed, non-volumetric revenue to fund infrastructure; fixed-charge reforms for other IOUs are queued up next.

California’s municipal and public utilities are reshaping solar economics too – most visibly by shrinking export compensation. Anaheim Public Utilities now pays wholesale-based (not retail) credits under NEM 2.0, and updates those export values annually. Statewide, the CPUC’s Net Billing design moves new solar customers to avoided-cost export values instead of retail rates, meaning self-consumption and storage are increasingly prized over exporting.

Why rates are likely to keep climbing

Three forces are lining up behind continued upward pressure:

- Wildfire & reliability spending. Regulators have allowed utilities to recover tens of billions in wildfire-related costs from 2019–2023, with additional risk-mitigation investments in the pipeline. Those recoveries, plus requests for higher authorized returns to reflect wildfire risk, keep base revenue requirements elevated.

- Transmission buildout + data-center load. CAISO’s 2024–2025 Transmission Plan flags major new lines to support electrification and rapidly rising large-load demand (AI/data centers). Big transmission programs are essential – but they aren’t cheap.

- Project cancellations & policy uncertainty. 2025 saw federal actions canceling $679M in funding for 12 offshore wind projects (including one in California), and states pausing transmission initiatives amid federal permitting uncertainty – signals that large-scale supply additions once expected to cool prices may be slower to arrive. Wholesale power price forecasts for 2025 also pointed to the biggest increases in California.

The ITC window: what changes in 2026

The Investment Tax Credit (ITC) is still extraordinarily valuable in 2025, but next year brings tighter rules that raise execution risk if you wait:

- Under the One Big Beautiful Bill Act (OBBBA), wind and solar facilities that begin construction after July 4, 2026 must be placed in service by December 31, 2027 to qualify for credits. That shorter runway raises schedule risk for late-starting projects.

- New foreign entity of concern (FEOC) restrictions begin phasing in, disqualifying projects that rely too heavily on flagged suppliers. Treasury/IRS guidance is still evolving, which increases compliance uncertainty and procurement complexity for projects kicked off in 2026.

- One bright spot: 100% bonus depreciation was restored and made permanent for most qualified property placed in service after Jan. 19, 2025 – an unusually strong first-year tax benefit that pairs well with the 30% base ITC (plus eligible adders).

Snapshot for decision-makers (the TL;DR)

- Rates: California commercial electricity prices remain among the highest in the U.S., with structural drivers (wildfire recovery, transmission spend) pointing upward.

- Tariffs: Net Billing and muni export revisions (e.g., Anaheim) reduce the value of exporting; solar + storage to shift and shave peaks is now the standard commercial playbook.

- Policy: Federal cancellations and pauses inject supply-side uncertainty, while OBBBA compresses the ITC eligibility window for projects that start after July 4, 2026 and layers on FEOC sourcing rules in 2026.

What this means if you operate in SCE, PG&E, SDG&E – or a muni

If your facility’s monthly bill regularly clears five figures, a 2025 start unlocks the strongest combination of benefits with the least policy risk: current-law ITC, bonus depreciation, and more flexible procurement before FEOC rules tighten. The economics are strongest when systems are right-sized to on-site load and paired with battery storage that arbitrages TOU peaks and mitigates lower export values.

How to move now (and move smart)

Revel Energy designs commercial solar + storage specifically for California rate structures (SCE, PG&E, SDG&E) and muni programs. In a free energy analysis, we’ll benchmark your current bill, model solar + storage under today’s tariffs (including Net Billing/export values), and map a compliant procurement path that avoids 2026 surprises while capturing 2025-level tax treatment.

Ready to explore your options before 2026 risk shows up on your bill? Book a free analysis and we’ll get your review started this week.

ROOFTOP SOLAR

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

ENERGY STORAGE

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

EV CHARGING STATIONS

As the popularity of EVs increase, so does the demand for on-site EV charging stations. This sustainable amenity has become a parking lot fixture for employers.

CREATING CAPITAL THROUGH SUSTAINABILITY, WE OFFER:

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

ENGINEERING, PROCUREMENT, CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.