A few weeks ago, we reminded businesses to secure their solar Investment Tax Credit before it potentially expires. Today, news of new Senate language sent back to Congress confirms the stakes have just gone higher .

Why 2025 Is Now Even More Critical

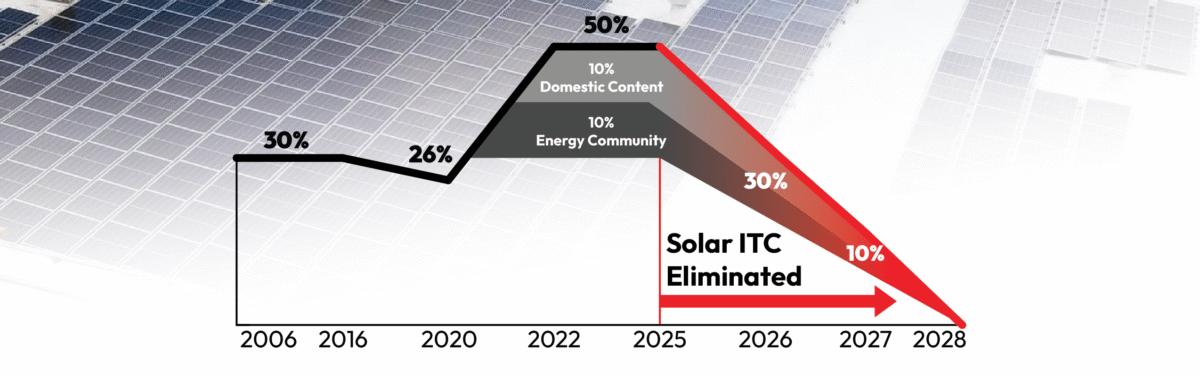

First ITC reductions begin in 2026, with a full phase-out by 2028 . In 2026, the credit decreases by 60% of its current value, in 2027 it goes down to 20% before phased out in 2028.

100% bonus depreciation has been restored for assets placed in service on or after January 19, 2025, and is now permanent.

What You Can Still Claim Only in 2025

A project that begins construction this year can capture:

30% Federal ITC

+10% Energy Community Adder (most of Southern California qualifies)

+10% Domestic Content Adder

100% Bonus Depreciation (recently updated in this legislation)

Together, you can potentially offset 50–60% of project costs in year one, or even more in some cases. Missing the construction window means watching those benefits shrink fast.

Why This Matters for Your Business

Maximizes tax efficiency now—with big depreciation write-offs and upfront credits.

Boosts ROI and cash flow, reducing payback periods significantly.

Secures long-term savings, even as electricity and energy costs continue to rise.

How to Act — Fast

Start by evaluating whether your site qualifies for energy community or domestic content bonuses.

Then, build a project timeline that ensures construction begins in 2025 to lock in full tax credit value.

Run financial models to estimate first-year savings by combining the ITC with 100% bonus depreciation.

Once ready, move quickly to execute – sign contracts, begin physical work, and document safe-harbor compliance in line with Treasury guidance.

Bottom Line

The Senate’s new language hasn’t just confirmed our original warning – it’s amplified it. The game-changing restoration of 100% bonus depreciation makes 2025 a rare and heightened window of opportunity for tax-smart solar installations. But these benefits are tied to congressional timing and project schedules.

If you’ve been considering solar or energy storage, this is decision time. Let’s help you model and move before the window closes.

Let’s preserve your tax credit and your energy future.

Contact us now or call (949) 281-7171 to schedule a fast, no-pressure consultation.

ROOFTOP SOLAR

Commercial grade rooftop solar is ideal for: manufacturing, warehousing, logistics, industrial, retail, hospitality buildings and more with over 10,000 sq. ft. rooftops.

CARPORT SOLAR

Free standing carport solar generates added solar power for properties with limited rooftop space. Added benefits include shading and protection for employees vehicles.

ENERGY STORAGE

Crucial for reducing peak demand charges. Automated to supply electricity when your panels won’t. Energy storage is ideal for businesses that incur significant peak charges.

EV CHARGING STATIONS

As the popularity of EVs increase, so does the demand for on-site EV charging stations. This sustainable amenity has become a parking lot fixture for employers.

CREATING CAPITAL THROUGH SUSTAINABILITY, WE OFFER:

PROFESSIONAL GUIDANCE

CUSTOM TAILORED PLANNING

ENGINEERING, PROCUREMENT, CONSTRUCTION & INSTALLATION

CSLB #1106092

Client Testimonial: Kelemen Company

Corporate Business Park in Irvine, CA has created significant electricity cost savings through commercial solar installed across the 5-building business park.

Client Testimonial: Tice Gardner & Fujimoto LLP

See how this CPA firm saved on electricity and gained valuable tax credits through commercial solar that they used to keep cash in the businesses.