Signed, Sealed – and Sunsetting: The Big Beautiful Bill is Now Law

On July 4, 2025, the Big Beautiful Bill (BBB) was officially signed into law, setting in motion a major shift in commercial solar policy (solar ITC) and project planning. While the dust has settled legislatively, the pressure is now on for businesses to act quickly if they want to capture full federal tax incentives before they begin to phase out.

Adding further urgency, the White House followed up with an executive order on July 5 titled “Ending Market-Distorting Subsidies for Unreliable Foreign-Controlled Energy Sources.” This order signals a broader federal shift toward strengthening domestic energy supply chains and tightening oversight of foreign-sourced materials. For solar developers, it underscores the risk that the definition of “start of construction” could become more rigid in future guidance. Getting projects moving this year not only ensures access to tax credits – it also puts you ahead of any future compliance hurdles that could complicate qualification later on.

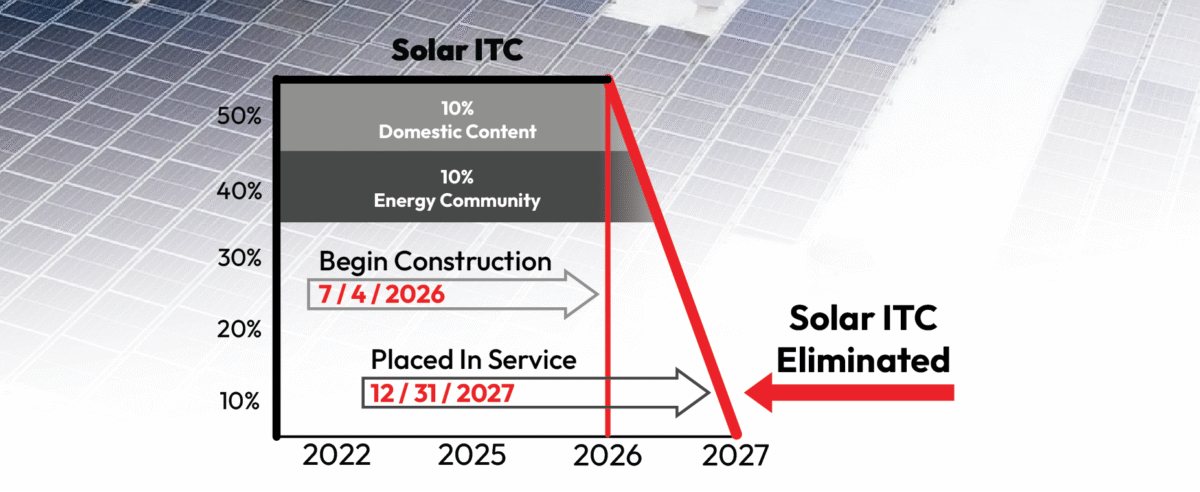

The legislation introduces a strict new timeline to qualify for the full Investment Tax Credit (ITC) and Production Tax Credit (PTC), while also enforcing sourcing rules and preserving bonus depreciation. But one of the most important aspects of the bill is its flexibility – projects can still qualify through one of two key paths.

Two Paths to Keep the Credit

The BBB offers commercial solar developers two distinct ways to qualify for full tax benefits – but projects must meet one of them:

- Start construction before July 4, 2026: If your project begins construction by this deadline, you lock in eligibility for the full ITC and bonus depreciation, with no placed-in-service deadline.

- Finish construction by December 31, 2027: If your project doesn’t start before July 4, 2026, it can still qualify for credits – but only if it is placed in service by the end of 2027.

Miss both deadlines and the opportunity to claim these incentives disappears entirely.

What’s Still on the Table

Projects that qualify under either pathway can still access the full range of tax benefits:

- 30% Base ITC: A direct credit on your federal tax bill.

- Up to 50% Total: Adders for domestic content and energy community location.

- 100% Bonus Depreciation: Immediate tax write-offs on qualifying system costs.

These incentives, combined with long-term utility savings, create a rare and time-sensitive financial opportunity for commercial building owners and operators.

From 60 Days to 12 Months: A Legislative Journey

The final BBB language represents a hard-fought compromise after months of political wrangling, specifically on the solar ITC. Early versions of the bill proposed giving businesses just 60 days to begin construction – a move that would have disqualified most real-world projects.

After heavy industry lobbying and bipartisan negotiation, the Senate extended the window to about six months. The final law now gives developers 12 months from enactment to start construction and preserve credit eligibility – a significant improvement, but still a compressed timeline by industry standards. This final version also introduced a firm placed-in-service requirement for those who miss the start date.

Foreign Sourcing Rules Still Apply

In addition to the updated timelines, the BBB includes important sourcing restrictions for some solar ITC applicants. Starting January 1, 2026, commercial solar projects that use equipment sourced from foreign entities of concern will not be eligible for the ITC or PTC.

While the originally proposed excise tax on foreign materials was removed from the final version of the bill, the disqualification risk remains. Businesses must take extra care when selecting panels, inverters, and storage components. Working with a knowledgeable EPC like Revel Energy helps ensure your procurement strategy stays compliant.

Understanding ITC Transferability

One of the most impactful tax features under current law is the ability to transfer the ITC to another taxpayer. This means businesses that don’t have enough tax liability to fully absorb the credit themselves can sell the credit, typically at a slight discount, to another entity that can.

This transferability creates flexibility for capital planning and increases access to solar investment for entities that would otherwise be limited by their tax position. It also allows developers or business owners to monetize the ITC without bringing in outside tax equity investors, helping streamline project financing.

How Depreciation Enhances the Investment

In addition to the ITC, qualifying solar projects can leverage 100% bonus depreciation, allowing the full cost of the system to be written off in the first year. For many businesses, this provides an immediate and significant tax shield against ordinary income.

Combined with the ITC, the depreciation benefit typically allows businesses to recover 50–60% of their system cost within the first year of installation – through tax savings alone. This aggressive front-loading of benefits improves return on investment and accelerates the break-even timeline.

Why This Matters Now

With BBB final policy language confirmed for the solar ITC, commercial solar developers and building owners can finally move forward with certainty – but the timeline is firm, and the clock is ticking.

Here’s why taking action in 2025 is critical:

- Lock in full tax benefits by starting before the July 4, 2026 deadline – or plan to finish construction by the end of 2027.

- Use approved materials to stay eligible for tax credits after January 2026

- Take advantage of credit transferability and depreciation-based tax offsets while they remain in place.

At Revel Energy, we help California businesses move quickly and strategically. From preliminary design and utility analysis to financing, tax modeling, and compliance management – we make it easy to take advantage of this final window of opportunity.

Let’s Talk Before the Window Closes

If your business owns its facility, is facing a significant tax burden, or simply wants to future-proof energy costs, now is the time to act.

Contact Revel Energy today to explore your eligibility and begin designing a project that meets the requirements of the Big Beautiful Bill – before the credits are gone for good.