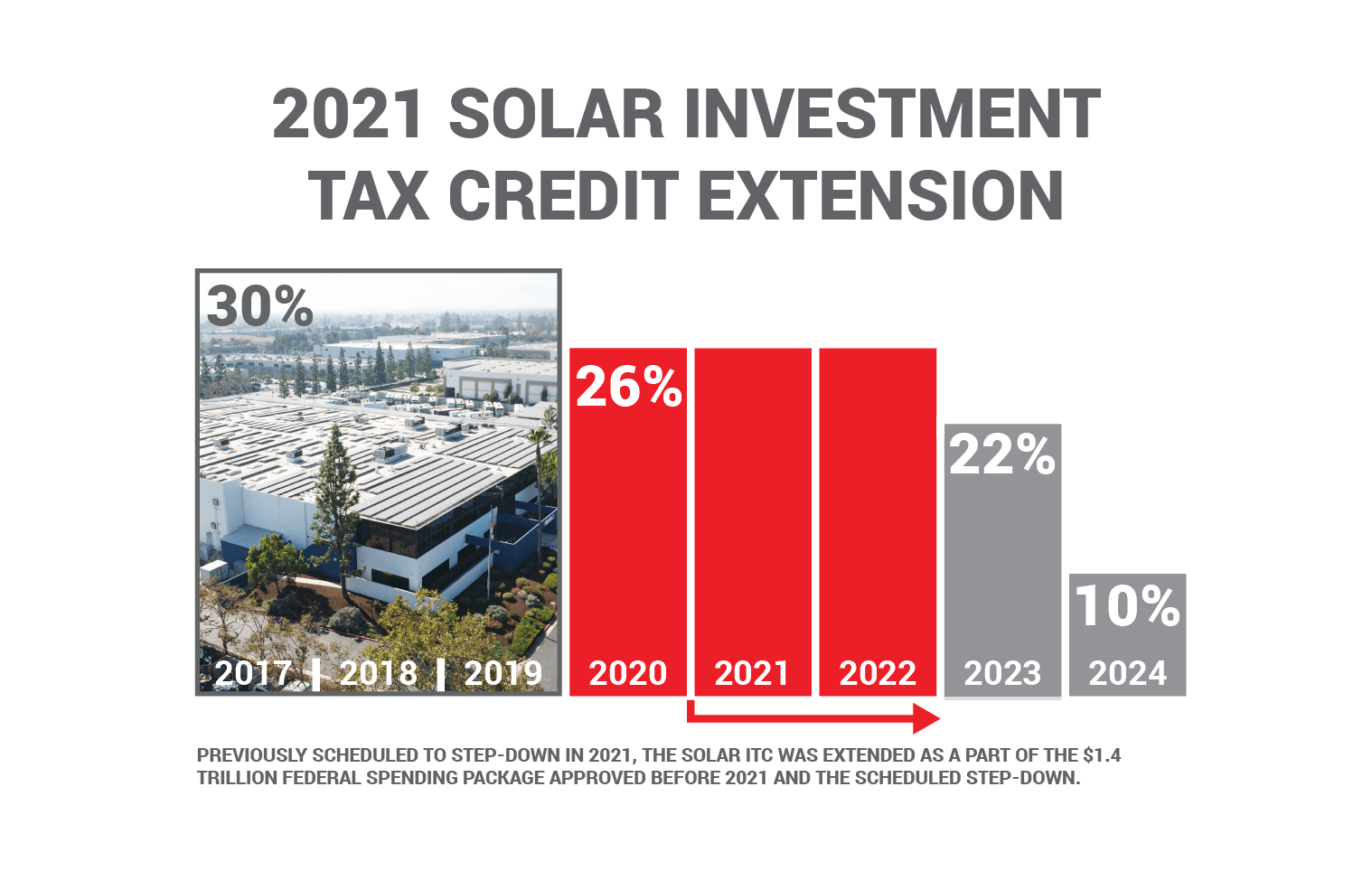

The 2021 Solar Investment Tax Credit (ITC) was scheduled to step down to 22% this year but will STAY at 26%. As part of the $1.4 Trillion federal spending package, the solar incentive stays high for California businesses looking to lower their electricity costs.

This means businesses investing in commercial solar will earn a dollar-for-dollar tax credit in the amount of 26% of the project cost.

The ITC extension adds a 4% saving on solar investments for anyone unable to hit the Dec 31, 2020 deadline for safe harbor. These savings come at a much-needed time for businesses. The 4% added savings help keep payback periods hovering around 2-3 years for typical solar investors.

California is slated to see exceptionally high electricity rate growth for 2021. One example is the CPUC approved an 8% rate increase in 2020 for PG&E customers. Other utility providers like Southern California Edison and SDG&E are expected to have similar rate hikes for their commercial customers.

California pays one of the highest electricity rates in the country, consistently rising to pay for the dilapidated grid. PG&E alone has 25,000 miles of outdated power lines in the queue for maintenance. Claim energy independence for your business and take advantage of the significant savings the ITC extension offers.