Solar Investment Tax Credits Are Scheduled to Step Down Next Year: What does that mean for your business’ solar project?

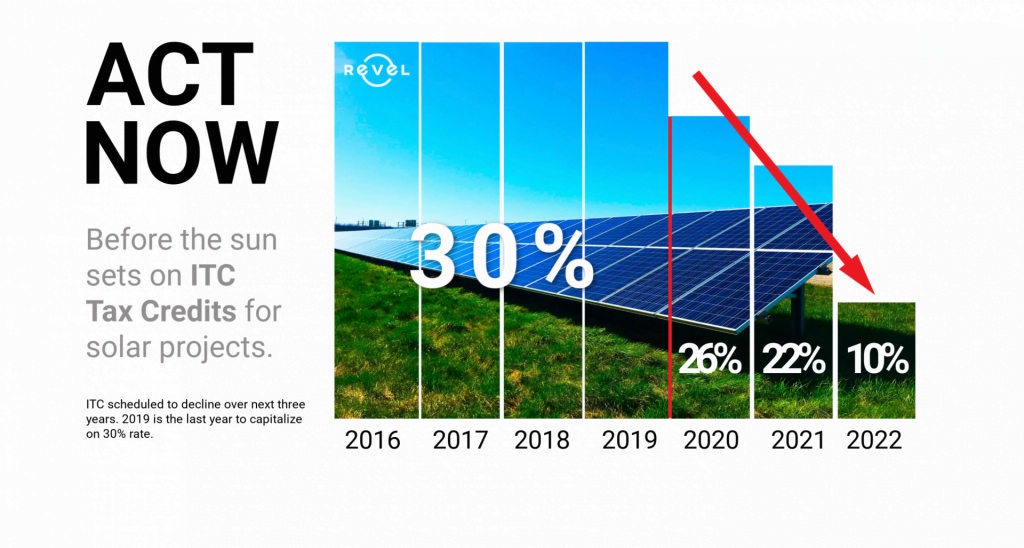

The federal tax credit intended to incentives US businesses to invest in commercial solar is stepping down from 30% to 26% in 2020. The following years will have steps downs as well. The 4 percentage points decrease looks nominal at first glance but for mid-sized commercial projects, this could mean the difference of tens of thousands of dollars in savings lost.

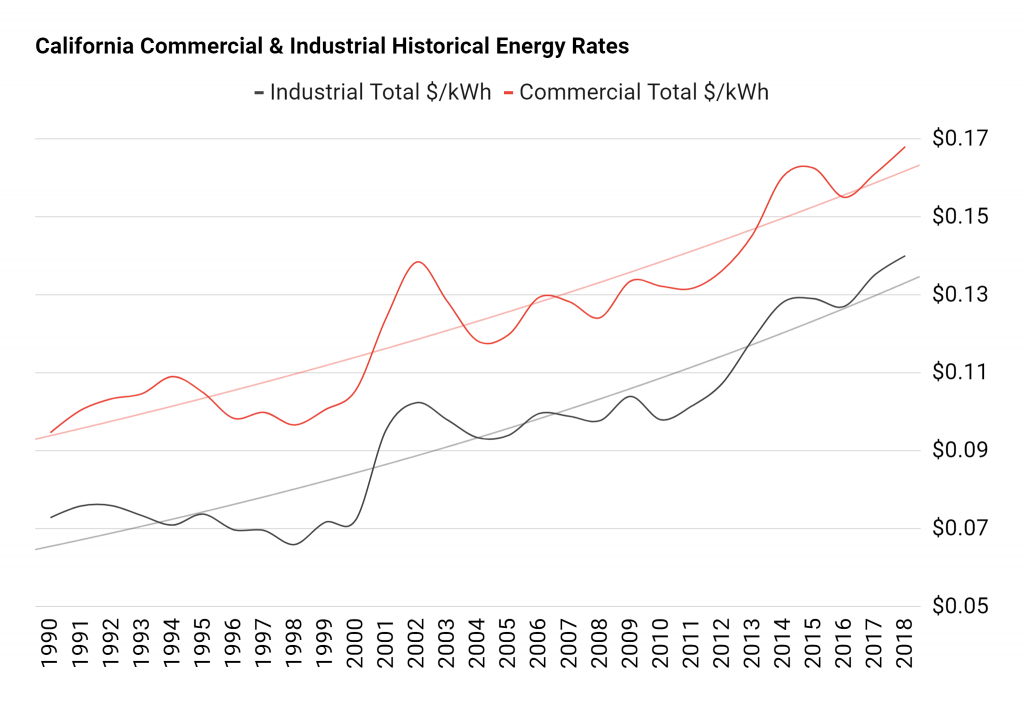

The ITC has proven an integral part of commercial solar’s fast growth over the past decade. This has been most important in California, where businesses pay the nation’s highest energy rates. California businesses that invest in solar not only drastically lower their energy bills, but they offset their tax liability (another area California leads the nation) through the valuable 30% ITC.

The solar ITC is a major determining factor for businesses that want to economically vet their investment. There are three ways to benefit from commercial solar (1) direct ownership, (2) Power Purchase Agreement (PPA) or (3) a solar operating lease. The solar ITC plays a big role in all three options’ affordability.

HOW WILL THIS AFFECT FUTURE INVESTMENTS?

“Going solar” currently has the fastest payback timeframe in its history. Many California businesses achieve 2-5-year payback. The scheduled step down of 4 percentage points could push payback periods longer. Investors that weigh decisions heavily on NPV and IRR will also want to take note. The lesser tax rate will affect these important metrics.

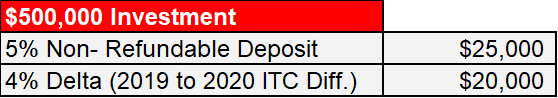

Let’s assume we have an installation with a price tag (before depreciation and ITC) of $500,000. After Federal and State incentives the Capital Outlay is about $170,000. If a project is started within the 2019 ITC period guidelines, it achieves a positive NPV 3 years faster. This also affects the IRR by almost 100 basis points.

California businesses that install solar drastically lower their electricity costs and gain a competitive advantage over their competition. California has outpaced the rest of the United States in energy cost growth and is currently around 40% higher than the national average.

HOW TO LOCK IN THE 30% ITC

California businesses have options to lessen the effects of the step-down. As per IRS Notice 2018-59, any business “beginning construction” in 2019 is eligible for the 30% rate. There are two options to qualify. The business must either pass the “Physical Work Test” by accomplishing significant physical work on the system or pass the “Five Percent Test” by paying or incurring 5% costs of the total system’s price tag.

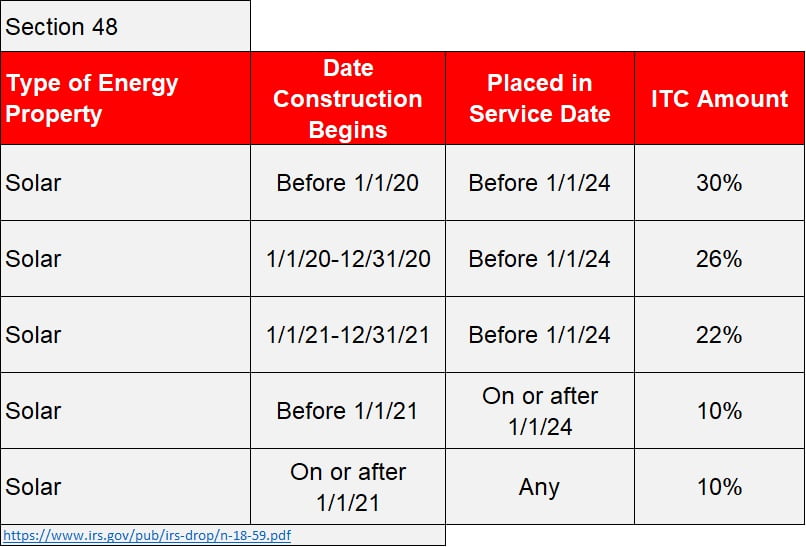

“For most types of energy property, eligibility for the ITC, and in some cases the amount of the ITC for which energy property is eligible, are dependent upon meeting certain deadlines for beginning construction on the energy property and placing the energy property in service. The table below summarizes these requirements.” -Section 48, IRS Notice 2018-59

Both options have their fine print and Revel Energy is not a tax professional. We always recommend consulting your tax expert for more details.

The “Five Percent Test” may be the clearest and most measurable option of the two. Five percent can be paid in the form of a non-refundable deposit. Keep in mind with a 2020 step down delta of 4 percentage points that is almost the non-refundable deposit right there.

Business owners that meet either of these requirements can benefit from the full 30% ITC if they continue to make “consistent progress” and complete the installation by 2023. It is important to work with an EPC or Project Developer that has a history of completing commercial grade projects on time.

CONCLUSION

Revel Energy works with many local businesses and property owners to help receive their best ROI on a commercial solar system. The ITC is an integral part of most purchases. Revel’s team of commercial solar specialists can help identify potential eligible projects. Solar investors that make prudent moves now can save large sums on the backend ultimately improving their investment returns.

About Revel Energy

Revel is on a mission. Dedicated to renewable energy solutions since 2009, Revel Energy was formed to provide Commercial, Industrial and Agricultural businesses with alternative energy beyond solar. Revel stands out from the competition by paying attention to what makes good business sense to each individual client, implementing a wider range of technologies to free up capital and make businesses sustainable and more profitable.