Lock In My ITC

Solar Investment Tax Credit (ITC) Highlights:

- 5% Non-refundable deposit by 12/1/22

- Equipment cost incurred (funds from deposit) by 12/31/22

- Equipment must have reasonable lead time max 3.5 month

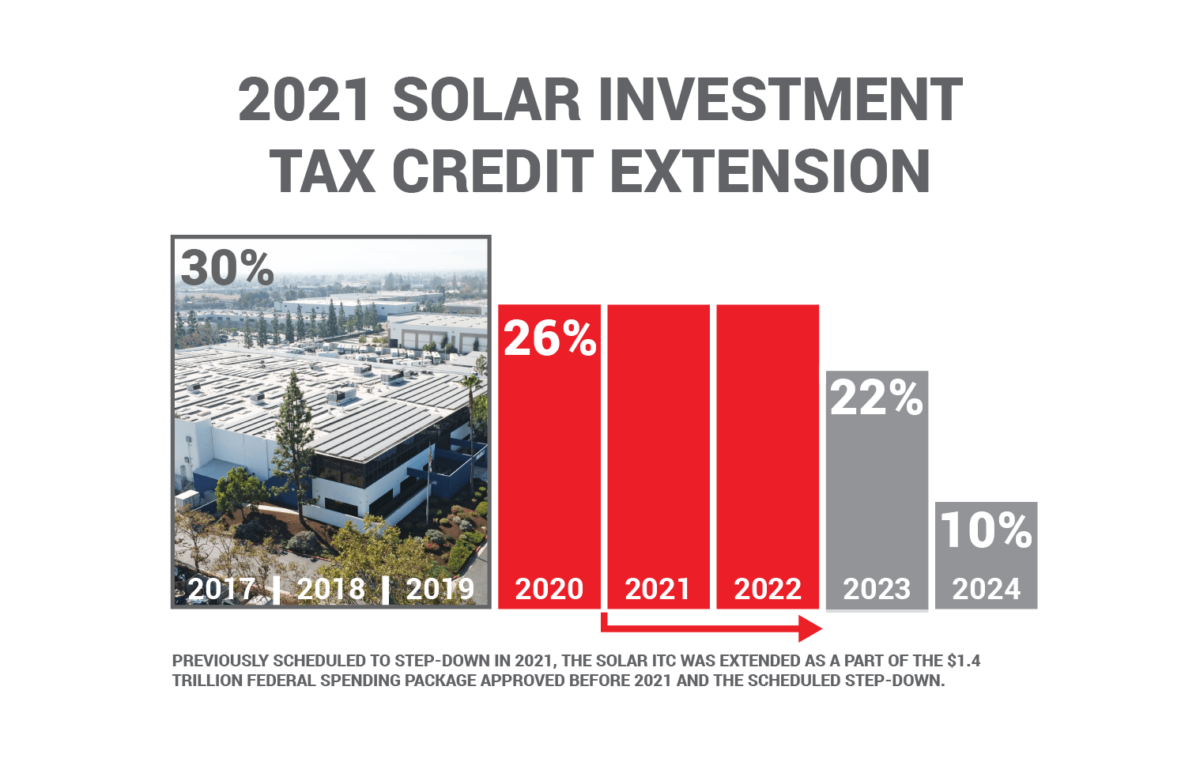

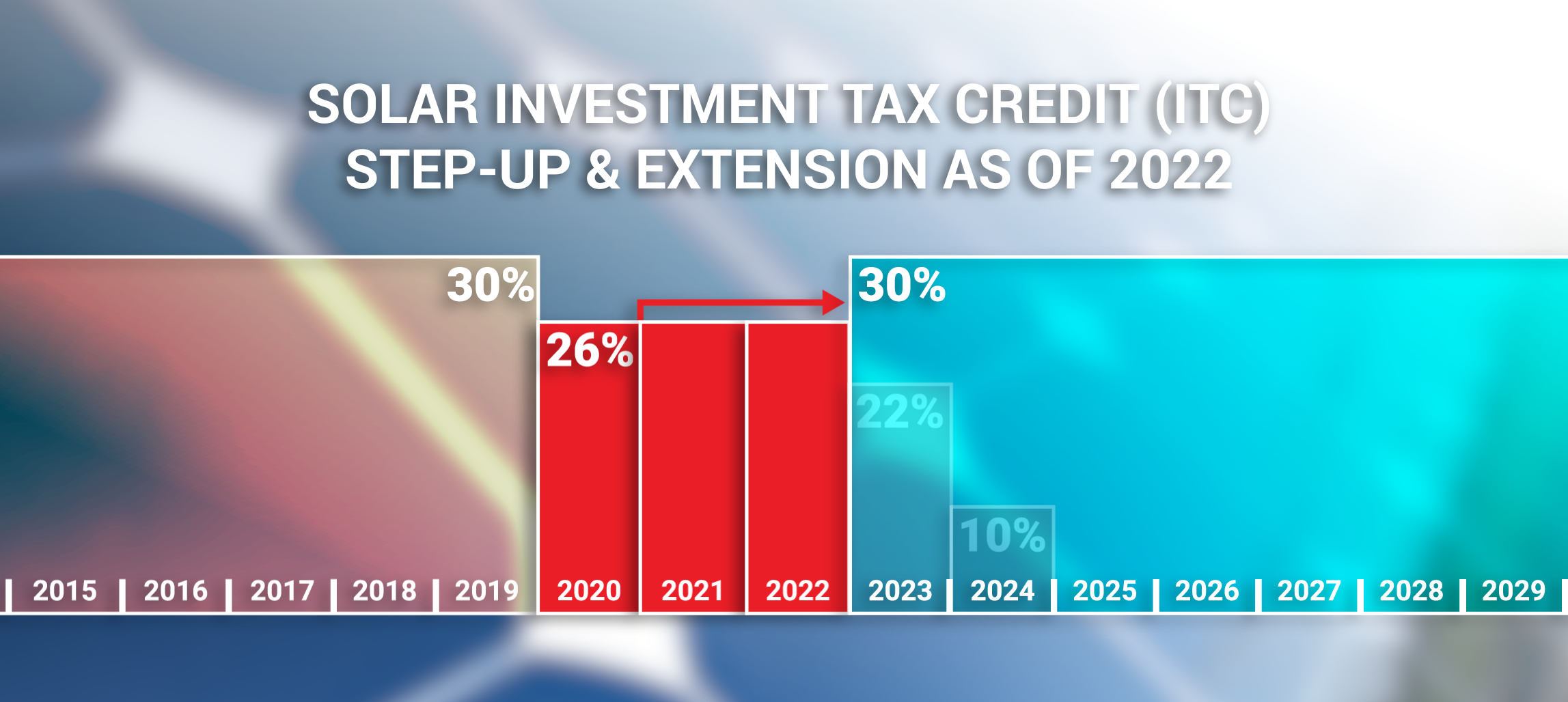

- 2023 steps down to 22%

- 2021 Q2 electricity rate are expected to hit historical highs again

HOW TO LOCK IN THE 26% ITC

Locking in your 2021 ITC rate will save your business thousands of dollars. The 2023 ITC is scheduled to stepdown 4 percentage points to 22% (10% for 2024). Locking in your 26% tax credit is simple but getting started right away with a comprehensive energy evaluation is important for timeline purposes.

As per IRS Notice 2018-59, any business “beginning construction” in 2020 is eligible for the 26% rate. There are two options to qualify. The business must either pass the “Physical Work Test” by accomplishing significant physical work on the system or pass the “Five Percent Test” by paying or incurring 5% costs of the total system’s price tag.

“For most types of energy property, eligibility for the ITC, and in some cases the amount of the ITC for which energy property is eligible, are dependent upon meeting certain deadlines for beginning construction on the energy property and placing the energy property in service. The table below summarizes these requirements.” -Section 48, IRS Notice 2018-59

2020 Amendment to the Rule as Per section 45 and 48 of the Code: Equipment costs must be paid or incurred before year-end, there must be a reasonable expectation that the equipment will be delivered within 3.5 months.

Because of this rule, Revel Energy recommends getting your deposit in by Dec 1, 2022 to ensure enough time to “safe harbor” you 26% ITC.

Both options have their fine print and Revel Energy is not a tax professional. We always recommend consulting your tax expert for more details.

The “Five Percent Test” may be the clearest and most measurable option of the two. Five percent can be paid in the form of a non-refundable deposit. Keep in mind with a 2023 step down delta of 4 percentage points that is almost the non-refundable deposit right there.

The “3.5 Month Safe Harbor Rule” is used to qualify you for the 2021 ITC rate by your contractor or developer procuring qualified equipment for the project with a reasonable lead time of delivery within 3.5 months of the order. The order must be placed before 1/1/22. **if a delivery is affected by covid-19, the order may still be considered “reasonably within the 3.5 month rule.”**

*Revel Energy recommends making a 7-10% deposit towards your project. This does not raise you net price but guarantees at least 5% of deposit is used for items qualified for the “Five Percent Test.” For more information consult a Revel specialist.

![]()

Business owners that meet either of these requirements can benefit from the full 26% ITC if they continue to make “consistent progress” and complete the installation by 2023. It is important to work with an EPC or Project Developer that has a history of completing commercial grade projects on time.

CONCLUSION

Revel Energy works with many local businesses and property owners to help receive their best ROI on a commercial solar system. The ITC is an integral part of most purchases. Revel’s team of commercial solar specialists can help identify potential eligible projects. Solar investors that make prudent moves now can save large sums on the backend ultimately improving their investment returns.