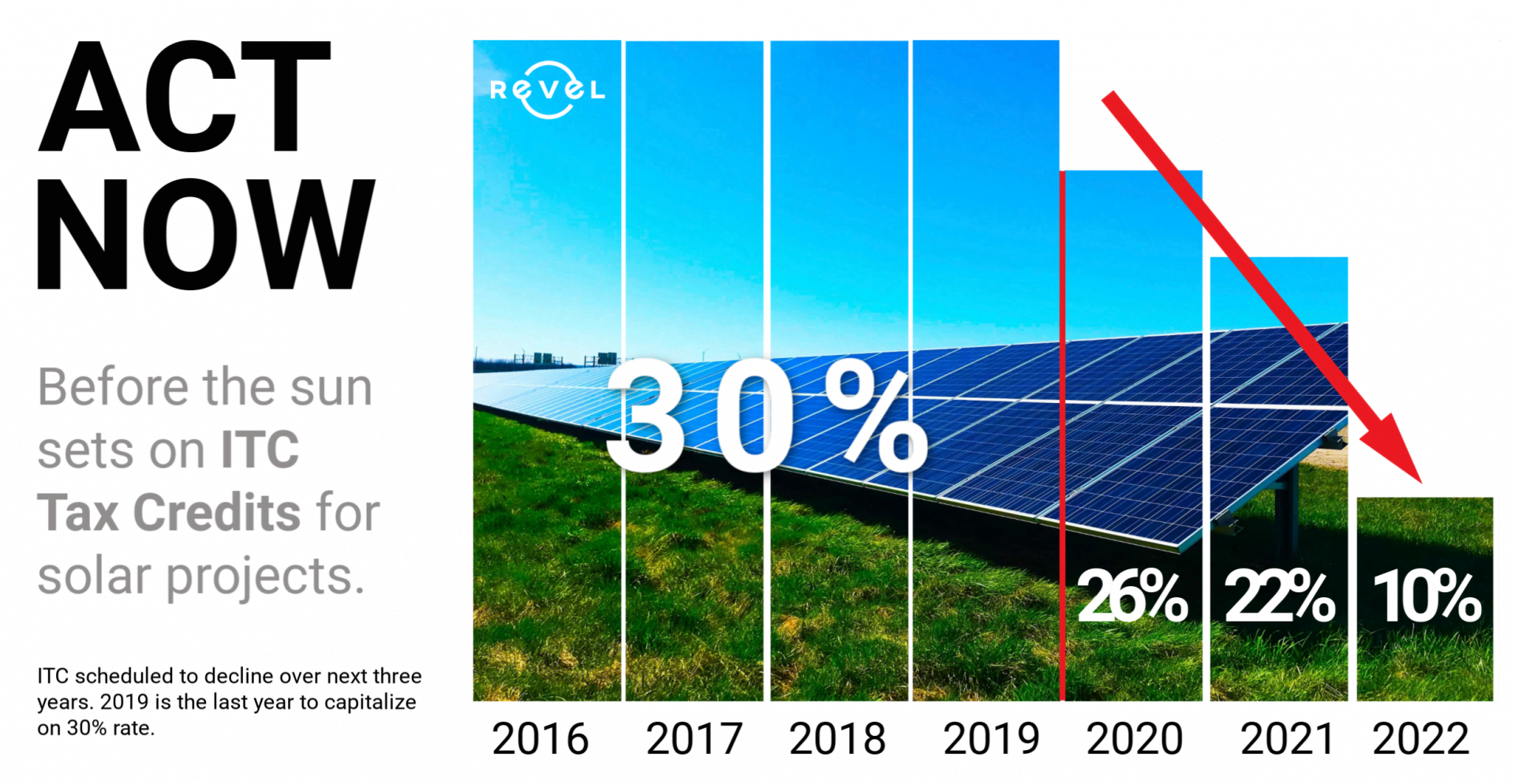

The Solar Investment Tax Credit helps businesses make commercial grade solar and other renewable technologies more affordable. The current 30% rate is scheduled to decline slowly over the next 2 years and settling at one-third the existing rate in 2022.

- Current: 30% ITC

- 2020: 26% ITC

- 2021: 22% ITC

- 2022: 10% ITC

In order to qualify in time for the 30% ITC your business must complete at minimum one of the following by December 31, 2019:

- Significant physical work (contact Revel for more information)

- Incurring costs of at least 5% of the cost of project (deposits may qualify, contact Revel for more information)

Commercial grade solar is an integral technology for California businesses to cut electricity costs. Without incentives like the Solar Investment Tax Credit (ITC), business owners find it hard to justify the high upfront cost for future savings. It should be noted that other incentives like accelerated depreciation have a shelf life and interested parties should contact a Revel Energy professional to learn more.

Below is a testimonial explaining Revel Energy’s professional services and the benefits of the Solar Investment Tax Credit.

Revel Energy and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisers before engaging in any transaction.