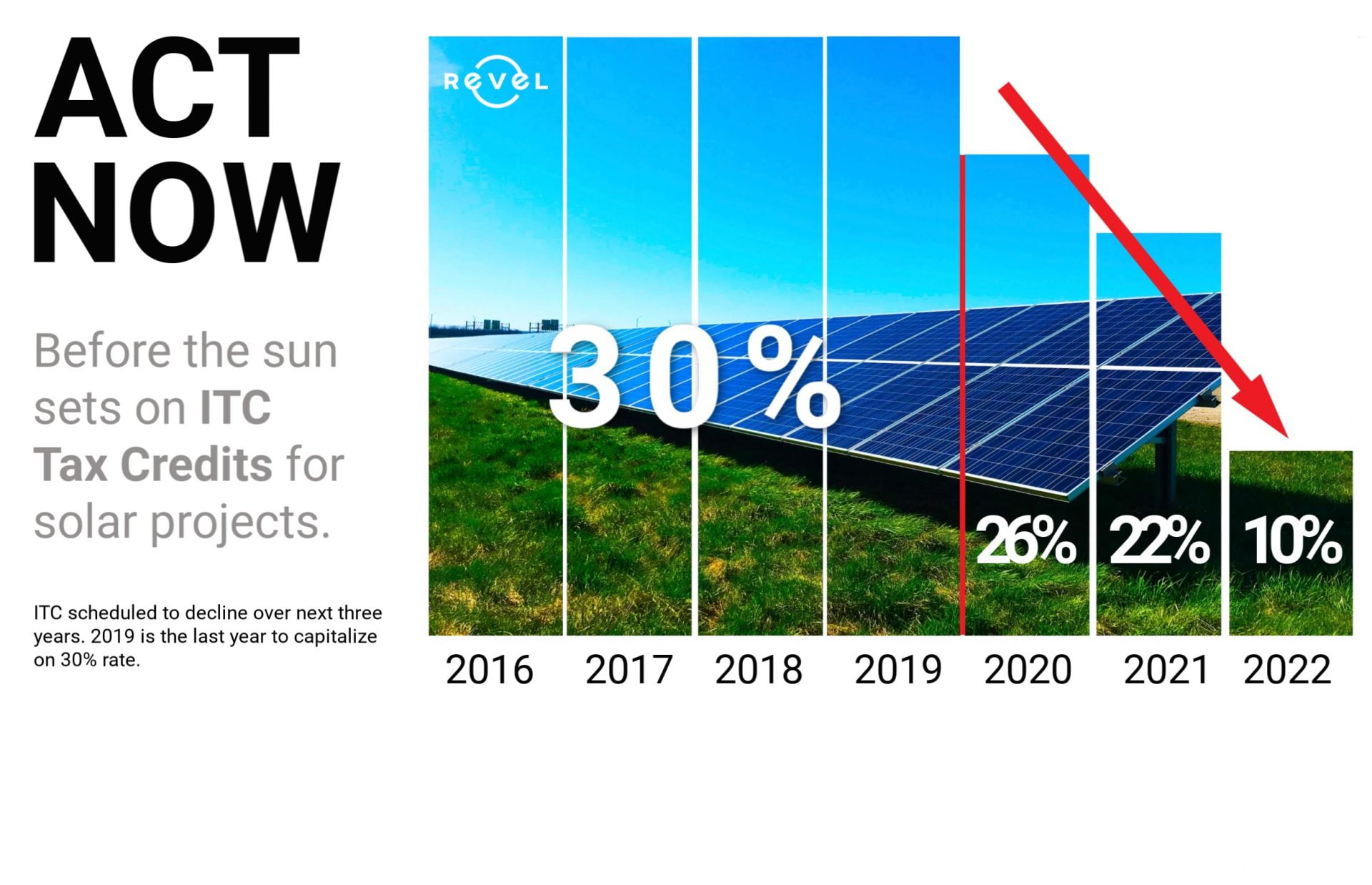

As 2019 comes to a close, time is running out. Below is an example of one company’s savings after locking in the 2019 ITC 30% Rate (Note: they are also going to have their system in time to save drastically on historically high summer electricity rates).

COMPARISON

Net Cost w/ 2019 ITC & Other Incentives… $271,393

Net Cost w/ 2020 ITC & Other Incentives… $307,374

Savings… $35,980

The are two ways to lock in your 2019 ITC 30% Rate.

HOW TO LOCK IN THE 30% ITC

California businesses have options to lessen the effects of the step-down. As per IRS Notice 2018-59, any business “beginning construction” in 2019 is eligible for the 30% rate. There are two options to qualify. The business must either pass the “Physical Work Test” by accomplishing significant physical work on the system or pass the “Five Percent Test” by paying or incurring a minimum of 5% costs of the total system’s price tag (Note: to ensure hitting the 5% eligible costs, in some cases, Revel will recommend a higher deposit to ensure qualifying for 2019 rate).

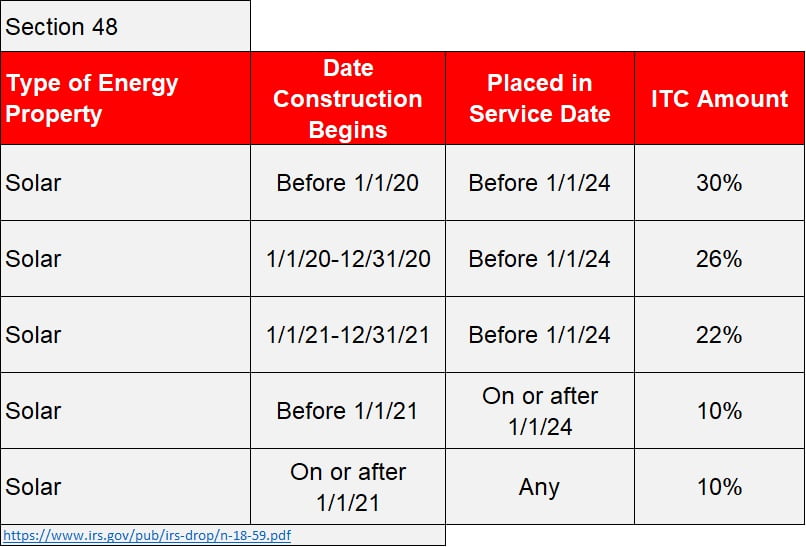

“For most types of energy property, eligibility for the ITC, and in some cases the amount of the ITC for which energy property is eligible, are dependent upon meeting certain deadlines for beginning construction on the energy property and placing the energy property in service. The table below summarizes these requirements.” -Section 48, IRS Notice 2018-59

Learn more about how to qualify here.

Other 2019 Major Savings Include

- Bonus Depreciation

- Discounted Electricity Rates (typically in the 50-80% range)

- Other Local Incentives