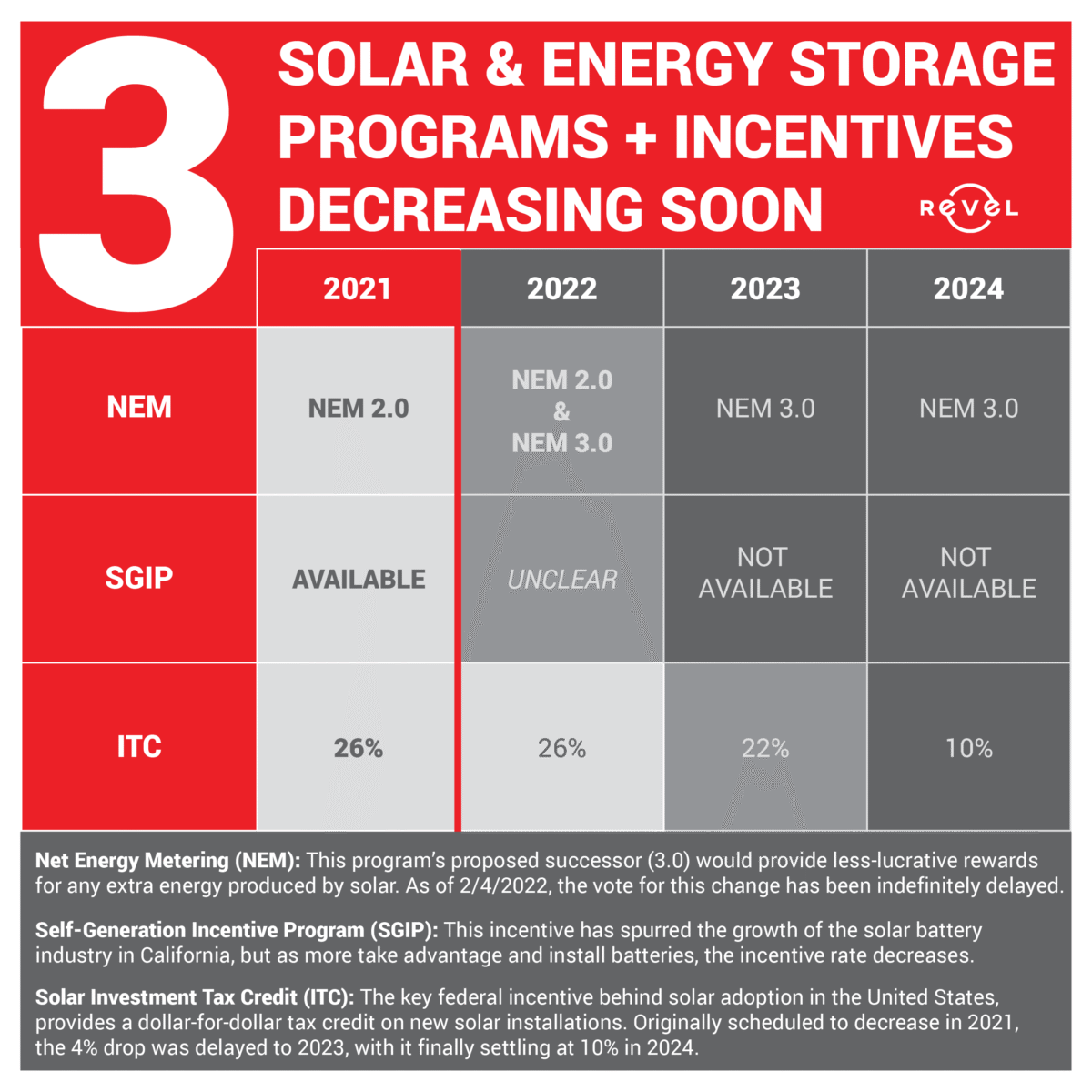

3 Decreasing Solar and Energy Storage Programs and Incentives

The freedom for California businesses to go solar is critical for their success. There is no secret, solar is an effective way to hedge against the state’s high electricity rates, Top 5 Energy Rates in the US.

The barrier of entry into this business-saving technology is currently very affordable but the critical incentives and programs used to help businesses are at risk of decreasing or disappearing in the coming years. The following three programs are set to decrease or disappear over the next 1-2 years making it more expensive for businesses to go solar.

These decreasing solar and energy storage incentives and programs face changes soon, but there is still time to lock-in the current benefits.

Net Energy Metering (NEM)

Net Energy Metering is a simple concept often over complicated. Solar users are compensated in the form of a credit for the electricity their solar panels produce which they do not use. In many cases, you can see your meter rolling backward when NEM is taking effect.

This is the least “set in stone” but a bankable expectation is that there will be major decreases in the credit value and significant fees tacked on for solar users. This will make the electricity your system generates less valuable, ultimately slowing down the payback period for your investment.

5 Things You Need to Know About NEM 3.0

There is still time to qualify for the current NEM program. Businesses that grandfather under the current program will be eligible when they do invest in solar for the program as it stands today. The first step is to start the energy audit for your business. This audit will help solar developers, like Revel Energy, design the ideal system with the shortest payback period and highest cash flow generation.

Here are some businesses that took advantage of these dwindling programs.

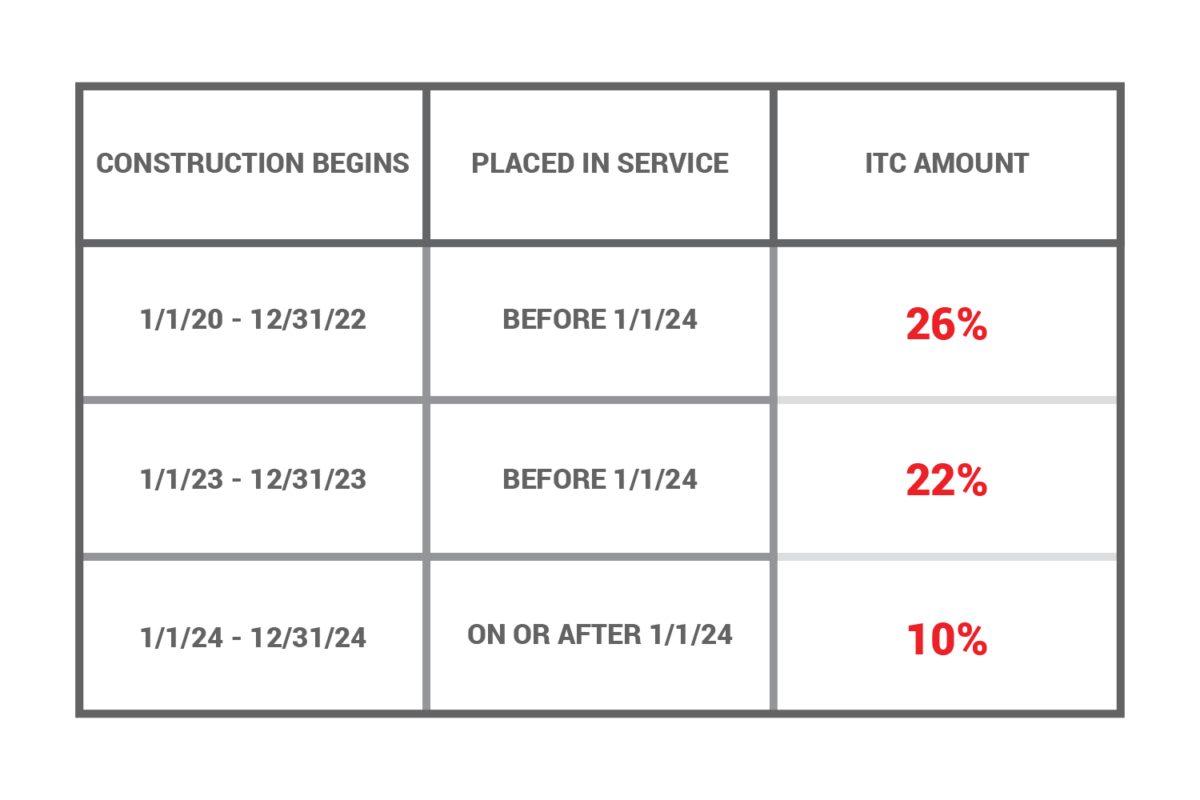

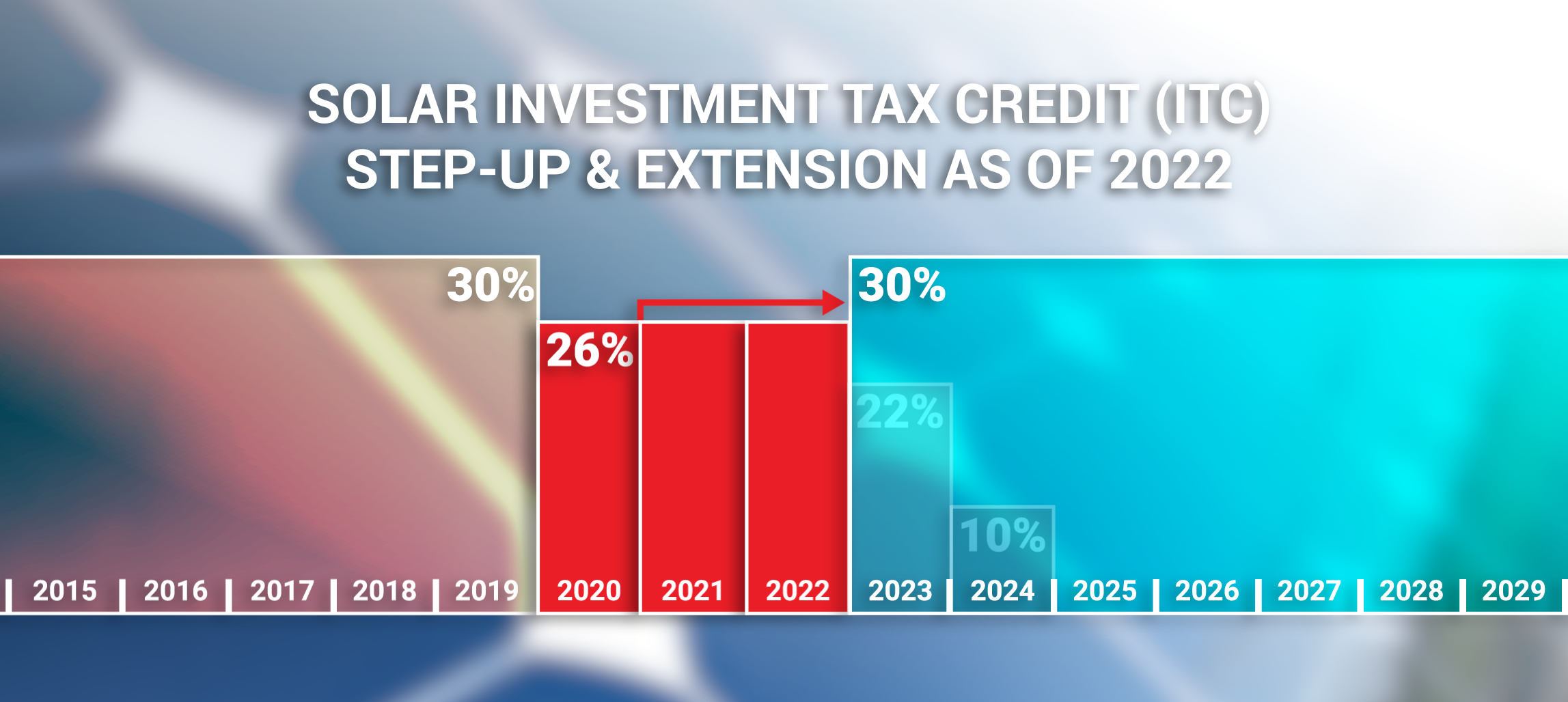

Solar Investment Tax Credit (ITC)

ITC is the most well known incentive for solar investors. For 2021, businesses that invest in solar earn a 26% tax credit based on the gross price of their system (i.e. a $500k system = $130k tax credit). The tax credit is a dollar for dollar credit.

There is much speculation as to what the current administration will do with the ITC. Many potential solar investors are hung up chasing “more lucrative incentives.” As it stands today, the 26% ITC is set to decrease at the end of 2022. There are no promises for an extension or any other type of structuring.

Every month that a business waits is another month of unnecessary electricity bills. These bills add up to negate any boost in incentives that may materialize in the future. The most reliable way to mitigate the payback period is to get started right away. Below is a schedule of milestones needed to qualify for the highest ITC rate.

Self-generation Incentive Program (SGIP)

SGIP is a rebate program set aside for businesses that choose to add energy storage to their system. Energy storage is ideal for businesses that incur high demand charges caused by short spikes in energy usage. The value depends on the size of the storage system and its usage.

Every year, there is a rush for businesses to qualify for SGIP due to its finite purse available. Put simply, there is X amount of dollars available for California businesses, once the purse is spoken for your business will have to wait for the next round of money allocated to the program. It is unclear if 2022 will have adequate money to run the program.

Getting an application in for SGIP is the first step pretty much after the system is designed. There is a waiting list and those who get in first get the much needed incentives to lower their net investment. Like the other programs, waiting only increases the payback period of your investment.

Conclusion

The decision to go solar is a big move for California businesses. The cost saving technology increases cash flow while providing a competitive advantage. Investing in solar is heavily dependent on incentives and programs to make payback periods as short as possible (often between 2-5 years).

Businesses that wait lose out on valuable dollars paying for electricity that could be free. They also extend their payback period due to pending reductions in incentives and frankly every month without solar is one more month added to payback periods.

The first step to qualifying for these incentives is free and simple without commitment. Consulting Revel Energy will get the process started by custom designing a system for your business. Applying for these programs is typically the next noncommittal step. Contact a Revel Energy developer today for your free solar design and proposal.